Get Covid-19 Impact Analysis with Sample Pages

Global Fire Testing Market Size, Share & Trend Analysis- By Type, By Application, By Survey – Regional Outlook, Competitive Tactics, and Segment Forecast to 2031.The worldwide market for Fire Testing is anticipated to exhibit a compounded annual growth rate (CAGR) of 5.87% during the period spanning from 2024 to 2031. Notably, the market’s valuation in 2023 stood at USD 7174.09 million, and this valuation is poised to ascend significantly to reach USD 11275.50 million by the 2031 of the aforementioned period.

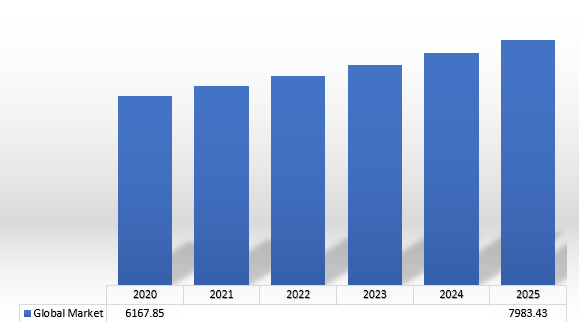

GLOBAL FIRE TESTING MARKET SIZE, (2020-2025), (USD MILLION)

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

In the period spanning from 2020 to 2025, the global market size for Fire Testing demonstrated a consistent upward trajectory, as illustrated in above. Commencing at $6167.85 million in 2020, the market experienced successive growth, reaching $7983.43 million by 2025.

GLOBAL FIRE TESTING MARKET SIZE, (2026-2031), (USD MILLION)

The trajectory of growth is expected to continue from 2026 to 2031, as depicted in above. Forecasts indicate a steady expansion in the global market for Fire Testing, with values progressing from $8435.29 million in 2026 to an estimated $11275.50 million in 2031. This extrapolated growth signifies a Compound Annual Growth Rate (CAGR) of 5.87% during the period from 2023 to 2031.

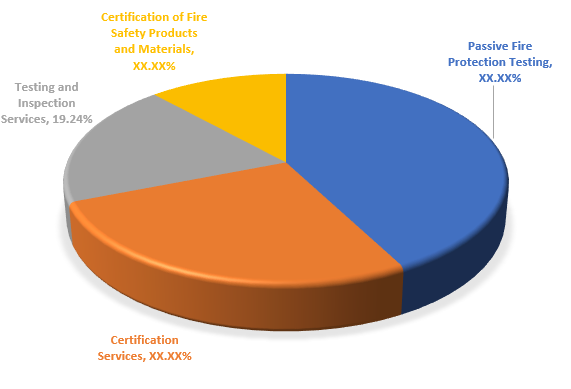

A. By Type

The Global Fire Testing Market encompasses various types of services, each contributing significantly to the overall market growth. Below is a detailed analysis of the market segments by type, including Passive Fire Protection Testing, Certification Services, Testing and Inspection Services, and Certification of Fire Safety Products and Materials. The analysis covers historical data from 2020 to 2023, projected values from 2024 to 2031, and the Compound Annual Growth Rate (CAGR) for each segment.

A1. Passive Fire Protection Testing

Passive Fire Protection Testing is the largest segment within the Global Fire Testing Market. This segment was valued at USD 2,596.66 million in 2020 and has shown consistent growth over the years. By 2023, it reached USD 3,035.94 million and is projected to grow further, reaching USD 3,206.25 million in 2024. The forecast suggests a steady increase, with the segment anticipated to achieve USD 4,835.64 million by 2031. The CAGR for Passive Fire Protection Testing from 2024 to 2031 is 6.05%, indicating robust growth driven by increasing regulatory requirements and heightened safety awareness across various industries.

Fire-resistant doors and windows testing: This testing evaluates the ability of doors and windows to withstand fire exposure for a specified period, ensuring they prevent the spread of fire and smoke. In the global fire testing market, this testing is crucial for certifying the performance of fire-rated barriers in buildings, enhancing occupant safety and complying with international building codes.

Structural fire protection testing: This involves testing the fire resistance of structural elements like beams, columns, and floors to assess their ability to maintain structural integrity during a fire. In the global market, these tests are vital for ensuring that buildings can withstand fire without collapsing, thereby protecting lives and reducing property damage.

Firestops and penetration seals testing: These tests assess the effectiveness of materials used to seal openings and penetrations in fire-rated walls and floors. This ensures that fire and smoke cannot pass through gaps around pipes, cables, and ducts. Globally, rigorous testing of firestops is essential for maintaining the integrity of fire compartments and preventing the rapid spread of fire.

Compartmentation and spatial separation testing: This testing evaluates the design and construction of fire compartments within a building to ensure they effectively contain fire within designated areas, slowing its spread. In the global fire testing market, compartmentation is a key strategy in fire safety, helping to protect occupants and property by dividing buildings into smaller, fire-resistant sections.

A2. Certification Services

Certification Services is another critical segment within the market. In 2020, the segment was valued at USD 1,643.11 million and grew to USD 1,915.77 million by 2023. The projection for 2024 is USD 2,021.41 million, with continuous growth expected to reach USD 3,030.33 million by 2031. This segment’s CAGR is 5.95%, reflecting the increasing demand for certification services to ensure compliance with fire safety standards and regulations globally.

Product certification for fire safety: This certification ensures that individual fire safety products, such as fire alarms, sprinklers, and extinguishers, meet established safety standards. In the global fire testing market, product certification is crucial for verifying that these products perform reliably under fire conditions, providing confidence to consumers and regulatory bodies.

System certification for fire safety: This involves certifying the performance of integrated fire safety systems, such as building-wide fire detection and suppression systems. Globally, system certification ensures that all components work together effectively to detect, contain, and extinguish fires, thereby enhancing overall building safety.

Personnel certification for fire safety competencies: This certification attests to the skills and knowledge of individuals responsible for fire safety measures, including fire risk assessors, inspectors, and installers. In the global market, personnel certification ensures that these professionals are qualified to implement and maintain fire safety protocols, ensuring adherence to safety standards and regulations.

Process certification for manufacturing and installation: This certification verifies that the processes used in the manufacturing and installation of fire safety products and systems meet quality and safety standards. In the global fire testing market, process certification is essential for ensuring that products are consistently produced and installed to the highest standards, minimizing the risk of failure during a fire.

A3. Testing and Inspection Services

Testing and Inspection Services play a vital role in the fire safety ecosystem. This segment was valued at USD 1,195.95 million in 2020 and increased to USD 1,380.23 million by 2023. For 2024, the projected value is USD 1,451.40 million, with an anticipated growth to USD 2,124.60 million by 2031. The segment’s CAGR of 5.59% underscores the growing necessity for regular testing and inspections to maintain fire safety standards in various infrastructures.

Fire detection systems testing: This service involves evaluating the performance of fire detection systems, such as smoke detectors and heat sensors, to ensure they can accurately and promptly identify the presence of fire. In the global fire testing market, testing fire detection systems is critical for ensuring early fire detection and timely response, thereby enhancing occupant safety and minimizing fire damage.

Fire suppression systems testing: This involves testing the functionality and effectiveness of systems designed to extinguish fires, such as sprinklers, gas suppression systems, and foam systems. Globally, fire suppression systems testing is essential for verifying that these systems can effectively control and extinguish fires, providing a crucial line of defense in fire emergencies.

Electrical safety testing for fire hazards: This testing assesses the safety of electrical installations and equipment to identify potential fire hazards, such as faulty wiring or overloaded circuits. In the global fire testing market, electrical safety testing is vital for preventing electrical fires, ensuring compliance with safety standards, and protecting lives and property.

Material flammability and resistance testing: This service tests the flammability and fire resistance of various materials used in construction and furnishings, such as textiles, insulation, and building materials. In the global market, material flammability and resistance testing is crucial for ensuring that materials used in buildings contribute to overall fire safety, reducing the risk of rapid fire spread and providing more time for evacuation.

A4. Certification of Fire Safety Products and Materials

The Certification of Fire Safety Products and Materials segment, although the smallest, is crucial for ensuring the safety and efficacy of fire safety products. It was valued at USD 732.12 million in 2020 and reached USD 842.15 million by 2023. The forecast for 2024 is USD 884.59 million, with growth expected to continue, reaching USD 1,284.93 million by 2031. The CAGR for this segment is 5.48%, highlighting the increasing need for certified fire safety products to meet stringent safety regulations and market demands.

Building materials fire safety certification: This certification process ensures that construction materials, such as insulation, drywall, and structural components, meet stringent fire safety standards. In the global fire testing market, certifying building materials for fire safety is essential for confirming their ability to resist ignition and prevent the spread of fire, thus contributing to the overall fire resistance of structures.

Fire extinguishing equipment certification: This certification verifies that fire extinguishing devices, including portable fire extinguishers, sprinkler systems, and fire hoses, comply with established safety and performance standards. Globally, certifying fire extinguishing equipment ensures these devices are reliable and effective in extinguishing fires, providing critical tools for fire suppression and emergency response.

Fire alarm systems certification: This involves certifying fire alarm systems, including detectors, control panels, and notification devices, to ensure they meet performance criteria for detecting and alerting occupants to fire. In the global fire testing market, fire alarm systems certification is vital for ensuring these systems provide timely and accurate warnings, enabling quick evacuation and response.

Emergency and exit lighting systems certification: This certification ensures that emergency lighting and exit signs function correctly and remain operational during power outages or fire situations. Globally, certifying emergency and exit lighting systems is crucial for ensuring that occupants can safely evacuate buildings during emergencies, thereby reducing the risk of injury and facilitating effective emergency response.

Global Fire Testing Market Share, (2023), by Type

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

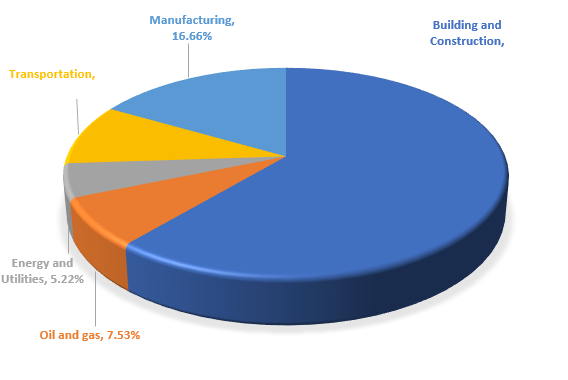

B. By Application

The Global Fire Testing Market is segmented by application, covering key areas such as Building and Construction, Oil and Gas, Energy and Utilities, Transportation, and Manufacturing. This segmentation helps in understanding the demand and growth trends specific to each sector. Below is a detailed analysis of the market segments by application, including historical data from 2020 to 2023, projected values from 2024 to 2031, and the Compound Annual Growth Rate (CAGR) for each segment.

B1. Building and Construction

The Building and Construction segment dominates the Global Fire Testing Market, reflecting the critical need for fire safety in infrastructure development. In 2020, this segment was valued at USD 3,756.84 million and grew to USD 4,390.22 million by 2023. The projected value for 2024 is USD 4,635.76 million, with steady growth expected, reaching USD 6,984.45 million by 2031. The CAGR for Building and Construction from 2024 to 2031 is 6.03%. This growth is driven by stringent building codes, increased construction activities, and heightened awareness of fire safety standards.

Residential buildings: In the context of the global fire testing market, fire safety testing and certification for residential buildings focus on ensuring that homes, apartments, and housing complexes meet fire safety standards. This includes testing materials, fire detection and suppression systems, and emergency exits to protect occupants from fire hazards and enhance overall safety in living spaces.

Commercial buildings: For commercial buildings, such as offices, shopping centers, and restaurants, fire testing services are essential to ensure that these structures comply with fire safety regulations. This includes rigorous testing of fire detection systems, suppression systems, and building materials to safeguard occupants and property, and to ensure business continuity in case of fire incidents.

Industrial facilities: In industrial facilities, which often contain hazardous materials and processes, fire safety testing is critical. The global fire testing market provides comprehensive testing of fire suppression systems, flammable material storage, and fire-resistant construction to mitigate the risk of industrial fires, protect workers, and minimize potential damage to equipment and facilities.

High-rise buildings: High-rise buildings pose unique fire safety challenges due to their height and occupancy density. Fire testing for these structures includes evaluating the performance of fire detection and suppression systems, fire-resistant materials, and emergency evacuation procedures. In the global market, ensuring high-rise buildings meet stringent fire safety standards is essential for protecting a large number of occupants and facilitating efficient emergency response in tall structures.

B2. Oil and Gas

The Oil and Gas sector is crucial for fire testing services due to the high-risk nature of its operations. In 2020, the segment was valued at USD 469.99 million, increasing to USD 540.29 million by 2023. For 2024, the projected value is USD 567.41 million, with growth expected to continue, reaching USD 823.04 million by 2031. The CAGR for this segment is 5.46%. The growth is attributed to the industry’s focus on safety measures and compliance with fire safety regulations.

Offshore drilling platforms: In the context of the global fire testing market, offshore drilling platforms require stringent fire safety measures due to their remote locations and the presence of highly flammable materials. Fire testing services for these platforms focus on evaluating fire suppression systems, fire-resistant materials, and emergency evacuation procedures to ensure the safety of personnel and the integrity of operations in the event of a fire.

Onshore oil fields: For onshore oil fields, fire testing is crucial to managing the fire risks associated with drilling and extraction activities. This includes testing fire detection and suppression systems, flammable material storage solutions, and emergency response plans. Ensuring these elements meet global fire safety standards is vital for protecting workers and minimizing environmental impact.

Refineries and petrochemical plants: Refineries and petrochemical plants handle volatile substances, making comprehensive fire testing essential. In the global fire testing market, this involves evaluating fire detection systems, suppression technologies, and the fire resistance of materials used in construction. Rigorous fire safety certification helps prevent catastrophic fires, ensuring operational safety and compliance with industry regulations.

Pipelines and transportation: Fire safety in pipelines and transportation infrastructure is critical due to the potential for large-scale fire incidents involving fuel or chemical leaks. Testing services focus on the integrity and fire resistance of pipeline materials, the effectiveness of fire detection systems, and the robustness of emergency response protocols. In the global market, ensuring these systems meet fire safety standards is crucial for preventing accidents and ensuring the safe transport of hazardous materials.

B3. Energy and Utilities

The Energy and Utilities segment also plays a significant role in the fire testing market. In 2020, the segment was valued at USD 326.28 million, growing to USD 374.18 million by 2023. The projected value for 2024 is USD 392.65 million, with an anticipated increase to USD 566.35 million by 2031. The CAGR for Energy and Utilities from 2024 to 2031 is 5.37%. This growth is driven by the need for reliable fire protection systems in power generation and distribution facilities.

B4. Transportation

The Transportation segment includes various modes such as automotive, aviation, and railways, all requiring rigorous fire safety standards. In 2020, this segment was valued at USD 583.48 million and grew to USD 674.20 million by 2023. The projected value for 2024 is USD 709.25 million, with an expected rise to USD 1,041.13 million by 2031. The CAGR for Transportation from 2024 to 2031 is 5.64%. The growth is due to the increasing adoption of fire safety measures in public and private transportation systems.

B5. Manufacturing

The Manufacturing sector demands fire testing services to ensure the safety of production facilities and workers. In 2020, the segment was valued at USD 1,031.26 million, increasing to USD 1,195.20 million by 2023. The projected value for 2024 is USD 1,258.58 million, with a steady growth trajectory expected to reach USD 1,860.53 million by 2031. The CAGR for this segment is 5.74%. This growth is driven by the emphasis on workplace safety and regulatory compliance in manufacturing operations.

Chemical manufacturing: In the context of the global fire testing market, fire safety in chemical manufacturing is paramount due to the high risk of fire and explosions associated with handling volatile chemicals. Fire testing services for this sector include evaluating fire suppression systems, fire-resistant materials, and emergency response plans. Ensuring that facilities meet stringent fire safety standards helps protect workers, equipment, and the environment from hazardous incidents.

Electronics and electrical manufacturing: Fire safety in electronics and electrical manufacturing focuses on preventing fires caused by electrical faults, overheating components, and flammable materials. Fire testing in this industry involves assessing the fire resistance of materials, the effectiveness of fire detection and suppression systems, and ensuring that manufacturing processes adhere to fire safety regulations. This is essential to safeguard both the manufacturing facilities and the products they produce.

Heavy machinery and equipment: Manufacturing heavy machinery and equipment often involves high-heat processes and the use of flammable materials, making fire safety critical. Fire testing services in this sector include evaluating the fire resistance of materials, testing the efficacy of fire suppression systems, and ensuring compliance with fire safety standards. Proper fire safety measures are vital to prevent costly equipment damage and ensure the safety of workers.

Textiles and garments: The textiles and garments manufacturing industry faces fire risks due to the flammable nature of fabrics and chemicals used in production. Fire testing services for this sector focus on assessing the flammability of materials, the performance of fire suppression systems, and the implementation of safe storage and handling practices. Ensuring fire safety compliance is essential to protect workers and reduce the risk of large-scale fires in manufacturing plants.

Global Fire Testing Market Share, (2023), by Application

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

C. By Survey

The Global Fire Testing Market is segmented by survey types, which include Fire Risk Assessments, Fire Safety Audits, and Fire Protection System Inspections. Each of these survey types plays a crucial role in maintaining and enhancing fire safety standards across various industries. Below is a detailed analysis of each survey type, including historical data from 2020 to 2023, projected values from 2024 to 2031, and the Compound Annual Growth Rate (CAGR) for each segment.

C1. Fire Risk Assessments

Fire Risk Assessments are essential for identifying potential fire hazards and implementing preventive measures. This segment was valued at USD 2,793.42 million in 2020, growing to USD 3,262.90 million by 2023. The projected value for 2024 is USD 3,444.90 million, with continuous growth expected, reaching USD 5,185.52 million by 2031. The CAGR for Fire Risk Assessments from 2024 to 2031 is 6.02%. The significant growth in this segment is driven by the increasing need for comprehensive risk evaluations to ensure fire safety in residential, commercial, and industrial settings.

C2. Fire Safety Audits

Fire Safety Audits are critical for ensuring compliance with fire safety regulations and standards. In 2020, this segment was valued at USD 2,237.69 million and grew to USD 2,595.74 million by 2023. The projected value for 2024 is USD 2,734.23 million, with growth expected to continue, reaching USD 4,050.43 million by 2031. The CAGR for Fire Safety Audits from 2024 to 2031 is 5.77%. The steady growth in this segment reflects the increasing emphasis on regular audits to maintain high levels of fire safety compliance and mitigate risks.

C3. Fire Protection System Inspections

Fire Protection System Inspections are vital for ensuring that fire protection systems, such as sprinklers and alarms, are functioning correctly and effectively. This segment was valued at USD 1,136.73 million in 2020, increasing to USD 1,315.45 million by 2023. The projected value for 2024 is USD 1,384.53 million, with an anticipated growth to USD 2,039.54 million by 2031. The CAGR for this segment is 5.69%. The growth in Fire Protection System Inspections is driven by the increasing installation of advanced fire protection systems and the need for their regular maintenance and inspection to ensure optimal performance.

A. Market Driver

A1. Stringent Regulatory Standards:

The primary driver in the global fire testing market is the enforcement of stringent regulatory standards and building codes across various industries and regions. Governments worldwide are increasingly imposing strict fire safety regulations to mitigate the risk of fire-related incidents and enhance public safety. Compliance with these standards necessitates thorough fire testing of materials, equipment, and structures, thereby driving demand for fire testing services.

A2. Growing Awareness of Fire Safety:

There is a heightened awareness of fire safety among consumers, businesses, and regulatory bodies, fueled by high-profile fire incidents and increasing emphasis on risk mitigation and disaster preparedness. As a result, there is a growing demand for comprehensive fire testing to ensure the efficacy of fire protection systems, equipment, and materials in preventing and mitigating fire hazards.

A3. Rising Investments in Infrastructure:

The escalating investments in infrastructure development, particularly in sectors such as construction, oil and gas, and transportation, are driving the demand for fire testing services. Infrastructure projects require stringent fire safety measures to protect assets, comply with regulatory requirements, and safeguard lives. Consequently, there is a growing need for fire testing to evaluate the fire resistance and performance of building materials, structural components, and fire protection systems.

A4. Technological Advancements:

Advances in fire testing technologies and methodologies are also driving market growth. Innovative testing techniques, such as computer simulations, thermal imaging, and predictive modeling, enable more accurate and efficient assessment of fire risks and performance of fire protection systems. These technological advancements enhance the capabilities of fire testing laboratories and provide clients with more reliable and actionable insights into their fire safety strategies.

A5. Increasing Complexity of Fire Risks:

The evolving nature of fire risks, including the emergence of new materials, technologies, and environmental factors, necessitates continuous adaptation and refinement of fire testing methodologies. As buildings become more complex, with integrated systems and advanced materials, there is a growing demand for specialized fire testing services to address unique fire safety challenges and ensure comprehensive risk mitigation.

A6. Globalization and Trade:

Globalization has led to increased cross-border trade and investment, driving harmonization of fire safety standards and requirements. Companies operating in multiple regions must ensure compliance with diverse regulatory regimes, spurring demand for standardized fire testing services that facilitate market access and regulatory compliance. This trend is further amplified by the globalization of supply chains, where manufacturers seek assurances of fire safety compliance from their suppliers through comprehensive fire testing.

B. Market Restraint

B1. Lack of Standardization:

The lack of standardized testing methodologies and protocols in certain areas of fire testing can hinder comparability and consistency of results. Harmonizing testing standards and procedures across industries and regions is essential to ensure the reliability and validity of fire testing outcomes.

B2. Data Interpretation and Reporting:

Interpreting fire testing data and communicating results effectively to stakeholders can be challenging, particularly when dealing with complex technical information. Ensuring clear and accurate reporting of test results is crucial for informing decision-making and implementing effective fire safety measures.

B3. Global Supply Chain Dynamics:

In an increasingly interconnected global economy, supply chain disruptions and dependencies can pose challenges for fire testing. Ensuring the fire safety compliance of products and materials sourced from diverse suppliers and locations requires robust testing and quality assurance processes.

B4. Public Perception and Awareness:

Despite efforts to raise awareness of fire safety risks and the importance of fire testing, public perception and understanding of fire safety measures may remain inadequate. Overcoming misconceptions and apathy towards fire safety requires ongoing education and outreach efforts by stakeholders in the fire testing industry.

C. Market Opportunity

C1. Expansion of Construction and Infrastructure Projects:

The ongoing expansion of construction and infrastructure projects, particularly in emerging markets and urban areas, presents significant opportunities for the global fire testing market. As new buildings, bridges, and transportation networks are constructed, there is a growing demand for fire testing services to ensure compliance with regulatory standards, mitigate fire risks, and enhance safety for occupants and assets.

C2. Technological Advancements in Fire Safety:

The rapid advancements in fire detection, suppression, and protection technologies present opportunities for innovation and growth in the fire testing market. As new materials, systems, and technologies are developed to improve fire safety performance, there is a corresponding need for comprehensive testing and evaluation to assess their effectiveness and reliability in real-world scenarios.

C3. Focus on Sustainability and Environmental Performance:

With increasing emphasis on sustainability and environmental performance in building design and construction, there is a growing demand for fire testing services that evaluate the environmental impact and sustainability of fire protection measures. Opportunities exist for fire testing laboratories to develop and offer testing protocols that assess the environmental footprint of fire protection systems, materials, and practices.

C4. Emerging Markets and Industry Verticals:

The expansion of fire testing services into emerging markets and industry verticals presents new opportunities for growth and diversification. As economies develop and industrial sectors expand, there is a rising demand for fire testing services to support regulatory compliance, risk management, and insurance requirements. By targeting emerging markets and niche industry verticals, fire testing laboratories can capitalize on new opportunities for business expansion and market penetration.

D. Market Challenges

D1. Complex Regulatory Landscape:

One of the primary challenges facing the global fire testing market is the complexity and variability of regulatory standards and requirements across different industries and regions. Adhering to diverse regulatory regimes adds complexity and cost to fire testing processes, especially for multinational companies operating in multiple jurisdictions.

D2. Technological Complexity:

The increasing complexity of building materials, systems, and technologies poses challenges for fire testing laboratories. Keeping pace with advancements in materials science, construction methods, and fire protection technologies requires continual investment in research, training, and equipment upgrades to ensure the effectiveness and relevance of fire testing methodologies.

D3. Resource Constraints:

Fire testing laboratories often face resource constraints, including limited funding, staffing shortages, and inadequate infrastructure. These constraints can impede the capacity of laboratories to meet growing demand for fire testing services and maintain high standards of quality and reliability.

D4. Evolution of Fire Risks:

The evolving nature of fire risks, including the introduction of new materials, technologies, and building designs, presents challenges for fire testing. Laboratories must continually adapt their testing methodologies to address emerging fire safety concerns and ensure the effectiveness of fire protection measures against evolving threats.

Recent Developments:

Conclusion:

The global fire testing market plays a pivotal role in safeguarding lives, property, and the environment from the devastating impact of fire hazards. As regulatory standards become increasingly stringent and public awareness of fire safety risks grows, the demand for comprehensive fire testing services continues to escalate across industries and regions worldwide. Fire testing laboratories conduct rigorous evaluations of materials, components, and systems to ensure their effectiveness in preventing, containing, and mitigating fires, thereby enhancing safety standards and regulatory compliance.

Looking ahead, the future scope of the global fire testing market appears promising, driven by several key factors. Firstly, the ongoing expansion of construction activities, infrastructure projects, and industrial developments presents significant opportunities for fire testing services. As economies recover from the COVID-19 pandemic and investments in critical infrastructure projects ramp up, there will be a growing demand for fire testing to ensure the safety and resilience of buildings, bridges, transportation networks, and industrial facilities.

Furthermore, technological advancements and innovations in fire testing methodologies and equipment are poised to shape the future landscape of the market. Digitalization, automation, and predictive modeling technologies are enhancing the efficiency, accuracy, and reliability of fire testing processes, enabling laboratories to deliver faster turnaround times and more precise results. Moreover, advancements in materials science, data analytics, and simulation technologies are driving the development of new testing solutions that address emerging fire safety challenges and enhance the effectiveness of fire protection measures.

The future outlook for the global fire testing market also includes a continued focus on sustainability and environmental performance. With growing concerns about climate change and environmental degradation, there is a rising demand for eco-friendly fire testing solutions that minimize the use of hazardous materials and reduce environmental impact. Fire testing laboratories that can offer sustainable testing services and demonstrate a commitment to environmental stewardship are likely to gain a competitive edge in the market.

Additionally, collaboration and partnerships between stakeholders in the fire testing ecosystem, including government agencies, industry associations, research institutions, and testing laboratories, will play a crucial role in driving innovation, standardization, and best practices in fire testing. By leveraging collective expertise and resources, stakeholders can address complex fire safety challenges, develop harmonized testing standards, and enhance the resilience of built environments against fire hazards.

In conclusion, the global fire testing market is poised for sustained growth and innovation, fueled by regulatory requirements, technological advancements, and increasing awareness of fire safety risks. Fire testing laboratories that can adapt to evolving market trends, embrace technological innovation, and demonstrate a commitment to excellence and sustainability are well-positioned to thrive in the dynamic and ever-evolving landscape of fire safety testing. With a steadfast dedication to enhancing fire safety standards and protecting communities from fire hazards, the global fire testing market is poised to make significant contributions to public safety and resilience in the years to come.

Market Breakup By Type

Market Breakup By Application

Market Breakup By Survey

The report has been prepared after analysing and reviewing numerous factors that denotes the regional development such as economic, environmental, social, technological, and political inputs of the country. The researchers have closely analysed the data of revenue, production, and manufacturers of each county. These analyses will help theto identify the important areas as potential worth of investment in the upcoming years.

GLOBAL FIRE TESTING MARKET SHARE, (2023), BY REGION

Regional Analysis:

North America shows a steady growth trajectory in the fire testing market. Starting at $2153.12 million in 2024, the market is projected to reach $3180.82 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.73%. This growth indicates increasing investments in fire safety technologies and regulations, driven by stringent safety standards across industries like construction, manufacturing, and automotive.

Europe exhibits a similar growth pattern to North America, with the market expanding from $1705.44 million in 2024 to $2508.76 million by 2031, corresponding to a CAGR of 5.67%. The region’s growth is supported by robust infrastructure development, heightened awareness of fire safety norms, and technological advancements in fire testing methodologies.

Asia Pacific emerges as the fastest-growing market for fire testing, starting at $3035.82 million in 2024 and projected to reach $4637.70 million by 2031, reflecting a notable CAGR of 6.24%. This growth is driven by rapid industrialization, urbanization, and increasing government initiatives to enhance fire safety standards across the region.

Latin America demonstrates moderate growth in the fire testing market, expanding from $282.20 million in 2024 to $394.62 million by 2031, with a CAGR of 4.91%. The region benefits from improving economic conditions, rising construction activities, and increasing awareness of fire safety measures.

Middle East & Africa also shows steady growth in the fire testing market, with revenues projected to increase from $387.06 million in 2024 to $553.60 million by 2031, achieving a CAGR of 5.25%. The growth is influenced by ongoing infrastructure projects, industrial developments, and efforts to align with international safety standards.

This section of the report identifies various key manufacturers of the market. It helps the reader understand the strategies and collaborations that players are focusing on combat competition in the market. The reader can will get an updated information on their revenue of manufacturers, product portfolio, recent development and expansion plans during the forecast period

Major players operating in the Global Fire Testing market are:

About Us:

Market Research Corridor is a global market research and management consulting firm serving businesses, non-profits, universities and government agencies. Our goal is to work with organizations to achieve continuous strategic improvement and achieve growth goals. Our industry research reports are designed to provide quantifiable information combined with key industry insights. We aim to provide our clients with the data they need to ensure sustainable organizational development.

Contact Us:

Avinash Jain

Market Research Corridor

Phone : +1 518 250 6491

Email: [email protected]

Chapter 1. Introduction

1.1. Report description

1.2. Key market segments

1.3. Regional Scope

1.4. Executive Summary

Chapter 2. Research Methodology

2.1. Secondary Research

2.2. Primary Research

2.3. Secondary Analyst Tools and Models

Chapter 3. Market Dynamics

3.1. Market driver analysis

3.2. Market restraint analysis

3.3. Market Opportunity

3.4. Market Challenges

3.5. Impact analysis of COVID-19 on the Fire Testing market

Chapter 4. Market Variables and Outlook

4.1. SWOT Analysis

4.1.1. Strengths

4.1.2. Weaknesses

4.1.3. Opportunities

4.1.4. Threats

4.2. Supply Chain Analysis

4.3. PESTEL Analysis

4.3.1. Political Landscape

4.3.2. Economic Landscape

4.3.3. Social Landscape

4.3.4. Technological Landscape

4.3.5. Environmental Landscape

4.3.6. Legal Landscape

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitute

4.4.4. Threat of New Entrant

4.4.5. Competitive Rivalry

Chapter 5. Fire Testing Market: Type Estimates & Trend Analysis

5.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

5.2. Incremental Growth Analysis and Infographic Presentation

5.2.1. Passive Fire Protection Testing

5.2.1.1. Market Size & Forecast, 2020-2031

5.2.2. Certification Services

5.2.2.1. Market Size & Forecast, 2020-2031

5.2.3. Testing and Inspection Services

5.2.3.1. Market Size & Forecast, 2020-2031

5.2.4. Certification of Fire Safety Products and Materials

5.2.4.1. Market Size & Forecast, 2020-2031

Chapter 6. Fire Testing Market: By Passive Fire Protection Testing Estimates & Trend Analysis

6.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

6.2. Incremental Growth Analysis and Infographic Presentation

6.2.1. Fire-resistant doors and windows testing

6.2.1.1. Market Size & Forecast, 2020-2031

6.2.2. Structural fire protection testing

6.2.2.1. Market Size & Forecast, 2020-2031

6.2.3. Firestops and penetration seals testing

6.2.3.1. Market Size & Forecast, 2020-2031

6.2.4. Compartmentation and spatial separation testing

6.2.4.1. Market Size & Forecast, 2020-2031

Chapter 7. Fire Testing Market: By Certification Services Estimates & Trend Analysis

7.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

7.2. Incremental Growth Analysis and Infographic Presentation

7.2.1. Product certification for fire safety

7.2.1.1. Market Size & Forecast, 2020-2031

7.2.2. System certification for fire safety

7.2.2.1. Market Size & Forecast, 2020-2031

7.2.3. Personnel certification for fire safety competencies

7.2.3.1. Market Size & Forecast, 2020-2031

7.2.4. Process certification for manufacturing and installation

7.2.4.1. Market Size & Forecast, 2020-2031

Chapter 8. Fire Testing Market: By Testing and Inspection Services Estimates & Trend Analysis

8.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

8.2. Incremental Growth Analysis and Infographic Presentation

8.2.1. Fire detection systems testing

8.2.1.1. Market Size & Forecast, 2020-2031

8.2.2. Fire suppression systems testing

8.2.2.1. Market Size & Forecast, 2020-2031

8.2.3. Electrical safety testing for fire hazards

8.2.3.1. Market Size & Forecast, 2020-2031

8.2.4. Material flammability and resistance testing

8.2.4.1. Market Size & Forecast, 2020-2031

Chapter 9. Fire Testing Market: By Certification of Fire Safety Products and Materials Estimates & Trend Analysis

9.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

9.2. Incremental Growth Analysis and Infographic Presentation

9.2.1. Building materials fire safety certification

9.2.1.1. Market Size & Forecast, 2020-2031

9.2.2. Fire extinguishing equipment certification

9.2.2.1. Market Size & Forecast, 2020-2031

9.2.3. Fire alarm systems certification

9.2.3.1. Market Size & Forecast, 2020-2031

9.2.4. Emergency and exit lighting systems certification

9.2.4.1. Market Size & Forecast, 2020-2031

Chapter 10. Fire Testing Market: By Application Estimates & Trend Analysis

10.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

10.2. Incremental Growth Analysis and Infographic Presentation

10.2.1. Building and Construction

10.2.1.1. Market Size & Forecast, 2020-2031

10.2.2. Oil and gas

10.2.2.1. Market Size & Forecast, 2020-2031

10.2.3. Energy and Utilities

10.2.3.1. Market Size & Forecast, 2020-2031

10.2.4. Transportation

10.2.4.1. Market Size & Forecast, 2020-2031

10.2.5. Manufacturing

10.2.5.1. Market Size & Forecast, 2020-2031

Chapter 11. Fire Testing Market: By Building and Construction Estimates & Trend Analysis

11.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

11.2. Incremental Growth Analysis and Infographic Presentation

11.2.1. Residential buildings

11.2.1.1. Market Size & Forecast, 2020-2031

11.2.2. Commercial buildings

11.2.2.1. Market Size & Forecast, 2020-2031

11.2.3. Industrial facilities

11.2.3.1. Market Size & Forecast, 2020-2031

11.2.4. High-rise buildings

11.2.4.1. Market Size & Forecast, 2020-2031

Chapter 12. Fire Testing Market: By Oil and gas Estimates & Trend Analysis

12.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

12.2. Incremental Growth Analysis and Infographic Presentation

12.2.1. Offshore drilling platforms

12.2.1.1. Market Size & Forecast, 2020-2031

12.2.2. Onshore oil fields

12.2.2.1. Market Size & Forecast, 2020-2031

12.2.3. Refineries and petrochemical plants

12.2.3.1. Market Size & Forecast, 2020-2031

12.2.4. Pipelines and transportation

12.2.4.1. Market Size & Forecast, 2020-2031

Chapter 13. Fire Testing Market: By Manufacturing Estimates & Trend Analysis

13.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

13.2. Incremental Growth Analysis and Infographic Presentation

13.2.1. Chemical manufacturing

13.2.1.1. Market Size & Forecast, 2020-2031

13.2.2. Electronics and electrical manufacturing

13.2.2.1. Market Size & Forecast, 2020-2031

13.2.3. Heavy machinery and equipment

13.2.3.1. Market Size & Forecast, 2020-2031

13.2.4. Textiles and garments

13.2.4.1. Market Size & Forecast, 2020-2031

Chapter 14. Fire Testing Market: By Survey Estimates & Trend Analysis

14.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

14.2. Incremental Growth Analysis and Infographic Presentation

14.2.1. Fire Risk Assessments

14.2.1.1. Market Size & Forecast, 2020-2031

14.2.2. Fire Safety Audits

14.2.2.1. Market Size & Forecast, 2020-2031

14.2.3. Fire Protection System Inspections

14.2.3.1. Market Size & Forecast, 2020-2031

Chapter 15. Fire Testing Market: Regional Estimates & Trend Analysis

15.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

15.2. Incremental Growth Analysis and Infographic Presentation

15.3. North America

15.3.1.1. Market Size & Forecast, 2020-2031

15.4. Europe

15.4.1.1. Market Size & Forecast, 2020-2031

15.5. Asia Pacific

15.5.1.1. Market Size & Forecast, 2020-2031

15.6. Middle East & Africa

15.6.1.1. Market Size & Forecast, 2020-2031

15.7. Latin America

15.7.1.1. Market Size & Forecast, 2020-2031

Chapter 16. Fire Testing Market: Country Estimates & Trend Analysis

16.1. Fire Testing Market value share and forecast, (2020 to 2031) (USD Million)

16.2. Incremental Growth Analysis and Infographic Presentation

16.3. U.S.

16.3.1.1. Market Size & Forecast, 2020-2031

16.4. Canada

16.4.1.1. Market Size & Forecast, 2020-2031

16.5. Mexico

16.5.1.1. Market Size & Forecast, 2020-2031

16.6. UK

16.6.1.1. Market Size & Forecast, 2020-2031

16.7. France

16.7.1.1. Market Size & Forecast, 2020-2031

16.8. Germany

16.8.1.1. Market Size & Forecast, 2020-2031

16.9. Russia

16.9.1.1. Market Size & Forecast, 2020-2031

16.10. Italy

16.10.1.1. Market Size & Forecast, 2020-2031

16.11. Spain

16.11.1.1. Market Size & Forecast, 2020-2031

16.12. China

16.12.1.1. Market Size & Forecast, 2020-2031

16.13. India

16.13.1.1. Market Size & Forecast, 2020-2031

16.14. Japan

16.14.1.1. Market Size & Forecast, 2020-2031

16.15. Indonesia

16.15.1.1. Market Size & Forecast, 2020-2031

16.16. South Korea

16.16.1.1. Market Size & Forecast, 2020-2031

16.17. Australia

16.17.1.1. Market Size & Forecast, 2020-2031

16.18. Brazil

16.18.1.1. Market Size & Forecast, 2020-2031

16.19. Argentina

16.19.1.1. Market Size & Forecast, 2020-2031

16.20. Saudi Arabia

16.20.1.1. Market Size & Forecast, 2020-2031

16.21. UAE

16.21.1.1. Market Size & Forecast, 2020-2031

16.22. South Africa

16.22.1.1. Market Size & Forecast, 2020-2031

Chapter 17. Competitive Landscape

17.1. Company Market Share Analysis

17.2. Vendor Landscape

17.3. Competition Dashboard

Chapter 18. Company Profiles

18.1. Business Overview, Product Landscape, Financial Performanceand Company Strategies for below companies

18.1.1. Intertek Group Plc

18.1.1.1. Company Overview

18.1.1.2. Financial Performance

18.1.1.3. Product Benchmarking

18.1.1.4. Geographic Footprint

18.1.1.5. Strategic Initiatives

18.1.2. UL Solutions Inc.

18.1.2.1. Company Overview

18.1.2.2. Financial Performance

18.1.2.3. Product Benchmarking

18.1.2.4. Geographic Footprint

18.1.2.5. Strategic Initiatives

18.1.3. FM Approvals LLC

18.1.3.1. Company Overview

18.1.3.2. Financial Performance

18.1.3.3. Product Benchmarking

18.1.3.4. Geographic Footprint

18.1.3.5. Strategic Initiatives

18.1.4. SGS S.A.

18.1.4.1. Company Overview

18.1.4.2. Financial Performance

18.1.4.3. Product Benchmarking

18.1.4.4. Geographic Footprint

18.1.4.5. Strategic Initiatives

18.1.5. Bureau Veritas

18.1.5.1. Company Overview

18.1.5.2. Financial Performance

18.1.5.3. Product Benchmarking

18.1.5.4. Geographic Footprint

18.1.5.5. Strategic Initiatives

18.1.6. DEKRA

18.1.6.1. Company Overview

18.1.6.2. Financial Performance

18.1.6.3. Product Benchmarking

18.1.6.4. Geographic Footprint

18.1.6.5. Strategic Initiatives

18.1.7. Applus+

18.1.7.1. Company Overview

18.1.7.2. Financial Performance

18.1.7.3. Product Benchmarking

18.1.7.4. Geographic Footprint

18.1.7.5. Strategic Initiatives

18.1.8. Element Materials Technology

18.1.8.1. Company Overview

18.1.8.2. Financial Performance

18.1.8.3. Product Benchmarking

18.1.8.4. Geographic Footprint

18.1.8.5. Strategic Initiatives

18.1.9. Exponent, Inc.

18.1.9.1. Company Overview

18.1.9.2. Financial Performance

18.1.9.3. Product Benchmarking

18.1.9.4. Geographic Footprint

18.1.9.5. Strategic Initiatives

18.1.10. BSI Group

18.1.10.1. Company Overview

18.1.10.2. Financial Performance

18.1.10.3. Product Benchmarking

18.1.10.4. Geographic Footprint

18.1.10.5. Strategic Initiatives

18.1.11. Siemens AG

18.1.11.1. Company Overview

18.1.11.2. Financial Performance

18.1.11.3. Product Benchmarking

18.1.11.4. Geographic Footprint

18.1.11.5. Strategic Initiatives

18.1.12. Johnson Controls International PLC

18.1.12.1. Company Overview

18.1.12.2. Financial Performance

18.1.12.3. Product Benchmarking

18.1.12.4. Geographic Footprint

18.1.12.5. Strategic Initiatives

18.1.13. Det Norske Veritas (DNV)

18.1.13.1. Company Overview

18.1.13.2. Financial Performance

18.1.13.3. Product Benchmarking

18.1.13.4. Geographic Footprint

18.1.13.5. Strategic Initiatives

18.1.14. TÜV Rheinland AG

18.1.14.1. Company Overview

18.1.14.2. Financial Performance

18.1.14.3. Product Benchmarking

18.1.14.4. Geographic Footprint

18.1.14.5. Strategic Initiatives

18.1.15. BRE Group

18.1.15.1. Company Overview

18.1.15.2. Financial Performance

18.1.15.3. Product Benchmarking

18.1.15.4. Geographic Footprint

18.1.15.5. Strategic Initiatives

18.1.16. MISTRAS Group

18.1.16.1. Company Overview

18.1.16.2. Financial Performance

18.1.16.3. Product Benchmarking

18.1.16.4. Geographic Footprint

18.1.16.5. Strategic Initiatives

18.1.17. VTEC Labs Inc.

18.1.17.1. Company Overview

18.1.17.2. Financial Performance

18.1.17.3. Product Benchmarking

18.1.17.4. Geographic Footprint

18.1.17.5. Strategic Initiatives

18.1.18. Kiwa NV

18.1.18.1. Company Overview

18.1.18.2. Financial Performance

18.1.18.3. Product Benchmarking

18.1.18.4. Geographic Footprint

18.1.18.5. Strategic Initiatives

18.1.19. Nemko

18.1.19.1. Company Overview

18.1.19.2. Financial Performance

18.1.19.3. Product Benchmarking

18.1.19.4. Geographic Footprint

18.1.19.5. Strategic Initiatives

18.1.20. QIMA

18.1.20.1. Company Overview

18.1.20.2. Financial Performance

18.1.20.3. Product Benchmarking

18.1.20.4. Geographic Footprint

18.1.20.5. Strategic Initiatives

Chapter 19. Conclusion

By clicking the “Download PDF” button, you are agreeing to the Terms of Use and Privacy Policy. We respect your privacy rights and safegaurd your personal information. We prevent the disclosure of personal information. We prevent the disclosure of personal information to third parties. Soon our team executive will contact you !

Our Executive will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

The report incorporates an analysis of factors that promote market growth. The report introduces the competitive landscape of the global market. This also provides a range of different market segments and applications that may affect the market in the future. The analysis is based on current market trends and historical growth data. It includes detailed market segmentation, regional analysis, and industry competition pattern.

The report effectively assesses the current market size and provides industry forecasts. The value of this market in 2019 is $XXX million, and the compound annual growth rate during 2021-2027 is expected to be XX%. (*Note: XX values will be given in final report)

We use data from the demand and supply side and paid databases. Our report mentions all the sources and methods used to collect data and information.

Yes, we provide country-specific data in reports and custom formats. In our report, we cover major countries and regions. However, if a specific area is required, we will happily provide the data that you need.

Yes, we will consider the scope to provide market share information and insights. This service is part of a custom requirement.

Yes, we will provide several hours of analyst support to solve your problem. Please contact our sales representative and will schedule a meeting with our analyst.

Yes, we provide specific sections of the report. Please contact our sales representative.

The Market Research Corridor contains a database of reports on various industries, but not all reports are listed on the website. Please contact our sales team according to your requirements.

We provide customers with targeted and specific objective-based research. You can contact an analyst for a product review to get an opinion. You can state your custom requirements and we will provide you with the best features.

Customization helps organizations gain insight into specific market segments and areas of interest. Therefore, Market Research Corridor provides customized report information according to business needs for strategic calls.

We work with customers all over the world. So far, we have cooperated with customers from other countries. Our perspective means we know what’s going on in your local market and what’s happening elsewhere in the world. We have cooperated with businesses like you. Market Research Corridor benefits from completing numerous consulting projects across industries. This is whatever you do, chances are we already have very similar experiences.

Market Research Corridor exploring new markets, developing new products, or leveraging niche growth opportunities, we have reports to accelerate and enhance your strategy.

Want us to send you latest updates of the current trends, insights, and more, signup to our newsletter (for alerts, special offers, and discounts).