Get Covid-19 Impact Analysis with Sample Pages

[150+ Pages Report] US Trailer Tires Market Size, Share & Trend Analysis- By Trailer Type, By Construction, By Rim Size, By Material, By Distribution Channel, By Aftermarket – Regional Outlook, Competitive Tactics, and Segment Forecast to 2031.

The US market for Trailer Tires is anticipated to exhibit a compounded annual growth rate (CAGR) of 5.18% during the period spanning from 2024 to 2031. Notably, the market’s valuation in 2023 stood at USD 3724.92 million, and this valuation is poised to ascend significantly to reach USD 5492.55 million by the concluding year of the aforementioned period.

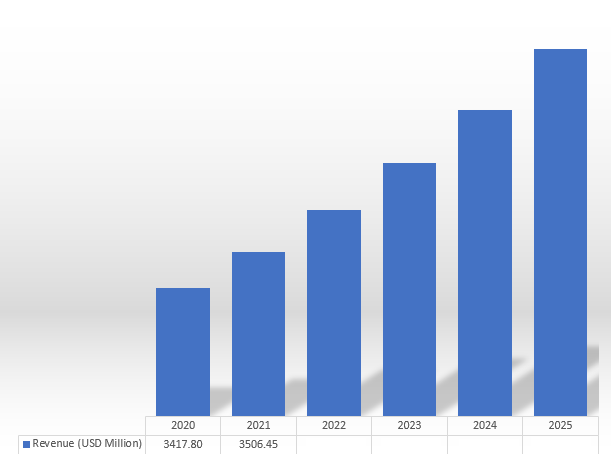

US TRAILER TIRES MARKET SIZE, (2020-2025), (USD MILLION)

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

In the period spanning from 2020 to 2025, the US market size for Trailer Tires demonstrated a consistent upward trajectory, as illustrated in above. Commencing at $ 3417.80 million in 2020, the market experienced successive growth, reaching $ 4004.88 million by 2025.

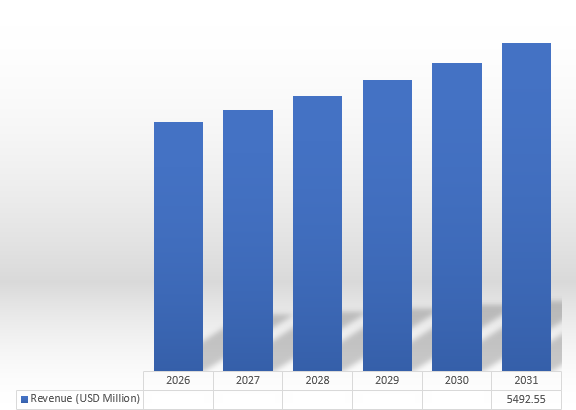

US TRAILER TIRES MARKET SIZE, (2026-2031), (USD MILLION)

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

The trajectory of growth is expected to continue from 2026 to 2031, as depicted in above. Forecasts indicate a steady expansion in the US market for Trailer Tires, with values progressing from $ 4178.20 million in 2026 to an estimated $ 5492.55 million in 2031. This extrapolated growth signifies a Compound Annual Growth Rate (CAGR) of 5.18% during the period from 2023 to 2031.

The US market for Trailer Tires is a dynamic landscape, witnessing robust growth across different Trailer Type, Construction, Rim Size, Material, Distribution Channel and Aftermarket.

By Trailer Type

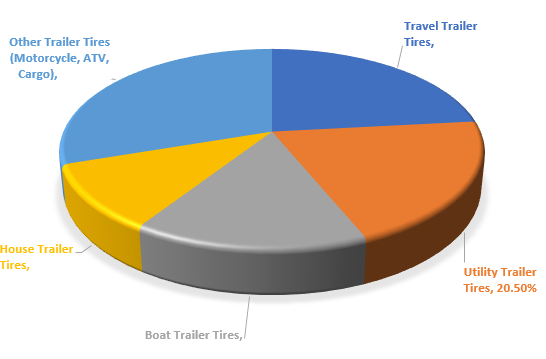

The US Trailer Tires Market is segmented by trailer type, with key categories including Travel Trailer Tires, Utility Trailer Tires, Boat Trailer Tires, House Trailer Tires, and Other Trailer Tires (Motorcycle, ATV, Cargo).

Among these, the Travel Trailer Tires segment emerges as the fastest-growing category, driven by the increasing popularity of recreational travel. This segment’s revenue is expected to grow from USD 908.00 million in 2024 to USD 1,388.45 million by 2031, showcasing an impressive CAGR of 6.25% over the forecast period.

Utility Trailer Tires represent another critical segment, with steady growth attributed to their widespread use in transportation and logistics. The segment’s value is projected to increase from USD 815.43 million in 2024 to USD 1,095.63 million by 2031, achieving a CAGR of 4.82%. Similarly, Boat Trailer Tires are expected to expand gradually, supported by rising recreational boating activities. The segment is estimated to grow from USD 606.83 million in 2024 to USD 795.72 million by 2031, registering a CAGR of 4.40%.

House Trailer Tires are also gaining momentum, driven by the increasing popularity of mobile and modular housing solutions. The segment is forecasted to grow from USD 417.94 million in 2024 to USD 538.86 million by 2031, with a CAGR of 4.11%. Meanwhile, the Other Trailer Tires category, which includes tires for motorcycles, ATVs, and cargo trailers, is set to witness notable growth. This segment is expected to rise from USD 1,211.46 million in 2024 to USD 1,673.89 million by 2031, reflecting a strong CAGR of 5.31%.

Overall, the market’s consistent growth across all segments highlights the increasing diversity of trailer tire applications, fueled by trends in recreational activities, transportation needs, and housing solutions. This underscores the expanding scope of the trailer tires market in the United States.

US Trailer Tires Market Share, (2023), by Trailer Type

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

By Construction

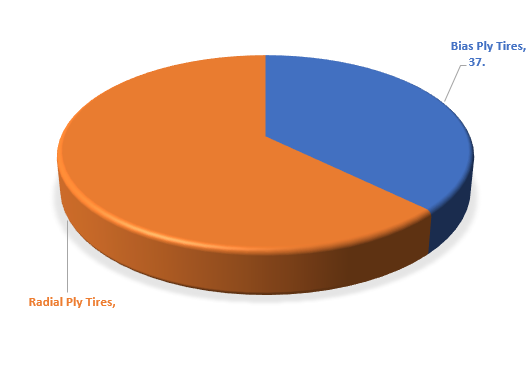

The US Trailer Tires Market is segmented by construction type, with the two primary categories being Bias Ply Tires and Radial Ply Tires. Bias Ply Tires, known for their durability and suitability for heavy-load applications, account for a significant portion of the market. The revenue for this segment is projected to grow steadily from USD 1,412.81 million in 2024 to USD 1,755.11 million by 2031, representing a modest but stable CAGR of 3.15% over the forecast period. This steady growth can be attributed to their continued use in specific niche applications where their robust design and affordability remain advantageous.

On the other hand, Radial Ply Tires dominate the market due to their superior performance, longer lifespan, and fuel efficiency, which make them increasingly preferred across various trailer types. The revenue for Radial Ply Tires is expected to rise significantly from USD 2,443.26 million in 2024 to USD 3,737.44 million by 2031, showcasing a strong CAGR of 6.26% during this period. This remarkable growth reflects the increasing adoption of advanced tire technologies and the growing demand for trailers equipped with tires that offer better handling, stability, and efficiency.

Overall, the growing preference for Radial Ply Tires is driving the construction type segment’s transformation in the US Trailer Tires Market. While Bias Ply Tires maintain their relevance in specialized uses, the advancements and benefits of Radial Ply Tires are steering the market’s evolution, aligning with trends favoring innovation and performance in the trailer industry. This segmentation highlights the diverse requirements of consumers and industries, underscoring the critical role of tire construction types in shaping the market landscape.

US Trailer Tires Market Share, (2023), by Construction

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

By Rim Size

The US Trailer Tires Market is segmented by rim size, with key categories including Small Trailer Tires (≤8″), Medium Trailer Tires (12-15″), and Large Trailer Tires (>16″). Each segment plays a significant role in catering to the diverse needs of trailers across the market.

Small Trailer Tires (≤8″) are commonly used for light-duty applications such as small utility trailers and compact recreational vehicles. This segment is expected to see steady growth from USD 1,232.35 million in 2024 to USD 1,581.71 million by 2031, achieving a CAGR of 3.63% during the forecast period. The consistent demand for these tires is driven by their affordability and suitability for lightweight trailers, making them a staple in the market.

Medium Trailer Tires (12-15″), which serve a wide range of mid-sized trailers including travel trailers and boat trailers, are the largest segment by revenue. In 2024, this segment is projected to generate USD 1,765.81 million, growing significantly to USD 2,612.05 million by 2031, with a robust CAGR of 5.75%. This growth is fueled by the increasing popularity of mid-sized trailers for both recreational and commercial use, as well as advancements in tire technology offering better performance and durability.

Large Trailer Tires (>16″), designed for heavy-duty trailers such as house trailers and cargo trailers, represent the fastest-growing segment. Revenue from this category is forecast to grow from USD 857.90 million in 2024 to USD 1,298.78 million by 2031, reflecting an impressive CAGR of 6.10%. The rise in demand for large trailer tires can be attributed to the growing use of heavy-duty trailers in industries such as logistics and construction, where durability and load-carrying capacity are critical.

In summary, the segmentation by rim size highlights the varying needs and applications of trailer tires in the US market. While small trailer tires remain essential for lightweight applications, medium and large trailer tires are driving growth, reflecting broader trends toward mid-sized and heavy-duty trailer use in both recreational and industrial sectors.

By Material

The US Trailer Tires Market is segmented by material into Rubber Tires and Solid Tires, each addressing distinct requirements and applications within the trailer industry. Rubber Tires, the dominant segment, are widely favored for their flexibility, affordability, and superior performance across various terrains. In 2024, the Rubber Tires segment is projected to generate USD 2,686.08 million, and by 2031, it is expected to reach USD 3,855.12 million, registering a robust CAGR of 5.30% during the forecast period. This growth is fueled by technological advancements in rubber compounding and design, enabling enhanced durability, better fuel efficiency, and improved traction, making them a preferred choice for both recreational and commercial trailer applications.

In contrast, Solid Tires cater to more specialized applications, particularly in industrial and heavy-duty environments where durability and resistance to punctures are paramount. This segment, valued at USD 1,169.98 million in 2024, is forecasted to grow to USD 1,637.43 million by 2031, with a CAGR of 4.92% during the same period. The growth of Solid Tires is attributed to their ability to withstand harsh operating conditions, making them ideal for trailers used in construction, agriculture, and other rugged applications.

This segmentation highlights the diverse material preferences in the US Trailer Tires Market, with Rubber Tires driving mainstream demand due to their versatility and Solid Tires meeting the needs of specialized industries. Together, these materials ensure the market caters to a wide array of trailer types and user requirements, supporting the overall growth of the sector.

By Distribution Channel

The US Trailer Tires Market is segmented by distribution channel, with key categories including Original Equipment Manufacturers (OEM) and the Aftermarket.

The Original Equipment Manufacturers (OEM) segment plays a critical role in the market, supplying tires for installation during the production of new trailers. In 2024, this segment is projected to account for USD 2,168.77 million, underscoring its importance in driving growth through partnerships with trailer manufacturers. By 2031, the OEM segment is expected to reach USD 2,996.63 million, growing at a CAGR of 4.73% during the forecast period. This steady growth is attributed to the increasing demand for high-quality, durable tires meeting stringent manufacturer specifications and the expanding trailer production industry in the United States.

The Aftermarket segment, on the other hand, is characterized by its focus on replacement tires and accessories for existing trailers. Valued at USD 1,687.30 million in 2024, this segment is forecasted to grow at a faster pace compared to OEMs, achieving a value of USD 2,495.92 million by 2031, with a CAGR of 5.75%. This robust growth is driven by factors such as the need for tire replacements in aging trailers, advancements in tire technology offering better performance, and the wide availability of aftermarket options catering to diverse customer requirements.

Overall, the distribution channel dynamics of the US Trailer Tires Market are shaped by the steady growth in OEM demand and the strong expansion of the Aftermarket segment, reflecting the evolving needs of both trailer manufacturers and end-users.

By Aftermarket

The US Trailer Tires Market is segmented by aftermarket sales, with key categories including Tire Only Sales and Tire/Wheel Assembly Sales. This segment plays a significant role in the overall growth of the market as it reflects the demand for replacement and upgraded tires, which are essential for trailer maintenance and performance enhancement over time.

The Tire Only Sales category in the aftermarket segment has been experiencing consistent growth. In 2020, sales were valued at $855.29 million, and this number increased gradually in the subsequent years. By 2021, the sales reached $877.50 million, followed by $903.30 million in 2022, and $932.04 million in 2023. Looking ahead, Tire Only Sales are projected to grow further, with an estimated value of $1,369.41 million by 2031, representing a compound annual growth rate (CAGR) of 5.13% from 2024 to 2031. This growth can be attributed to an increasing demand for high-performance tires, the necessity of replacing worn-out tires, and an overall rise in trailer usage.

Similarly, the Tire/Wheel Assembly Sales category has demonstrated an upward trend. In 2020, the sales for this segment stood at $608.29 million. By 2021, sales increased to $632.17 million, and this growth continued in 2022 with $659.22 million in sales and $689.10 million in 2023. By 2031, the Tire/Wheel Assembly Sales category is expected to reach $1,126.51 million, showing a strong CAGR of 6.55% from 2024 to 2031. The increasing demand for tire and wheel assemblies is largely driven by the need for integrated solutions that offer enhanced durability, especially for trailers such as utility and boat trailers that require robust performance.

Overall, the aftermarket segment of the US Trailer Tires Market continues to expand with both Tire Only Sales and Tire/Wheel Assembly Sales showing significant growth. These trends highlight the importance of replacement and upgrade tires for the long-term maintenance and performance of trailers. As the market evolves, these aftermarket sales categories will play a critical role in meeting the growing demand for high-quality, durable trailer tires in the US.

Driver, Restraint, Challenge and Opportunities Analysis

Market Driver

Increasing Demand for Freight and Logistics Transportation:

The US trailer tires market is significantly influenced by the growing demand for freight and logistics transportation. The expansion of e-commerce and the need for efficient supply chain management has led to a rise in the transportation of goods across the country. As businesses seek faster and more reliable delivery systems, the demand for commercial trailers, including dry vans, flatbeds, and refrigerated trailers, has surged. These trailers require durable and high-performance tires to support the weight of goods, improve fuel efficiency, and reduce maintenance costs. The continuous growth in freight demand is directly correlated with the need for trailer tires, making this a major driver for market growth.

Rising Construction and Infrastructure Development:

The growth of the construction and infrastructure sectors in the United States is another key driver of the trailer tire market. Construction projects, particularly those involving heavy machinery, rely heavily on trailers to transport construction materials, equipment, and machinery to job sites. With a booming construction market fueled by both public and private investments in infrastructure, the demand for trailer tires has expanded. Trailer tires are essential for maintaining the safe transportation of oversized loads, ensuring operational efficiency, and preventing costly downtime due to tire failures. This has led to a sustained demand for tires that can handle the tough, varied conditions encountered in the construction industry.

Technological Advancements in Tire Manufacturing:

Technological advancements in tire manufacturing are transforming the US trailer tire market. Innovations such as improved tread patterns, enhanced rubber compounds, and advanced tire construction techniques are leading to tires with better performance, longer lifespan, and lower maintenance costs. For instance, tires designed with specialized tread designs are providing better traction, leading to improved safety, especially on long-haul trips. The integration of technology such as sensors and smart tires that monitor tire health in real-time is also becoming more common, contributing to the growing appeal of high-tech tires. These advancements not only improve the overall efficiency of trailer tires but also provide better fuel efficiency and cost savings, making them attractive to fleet owners.

Growing Fleet Utilization and Replacement Cycle:

The increasing fleet utilization and shorter replacement cycles for trailer tires play a significant role in driving the US market. As the trucking and transportation industries continue to grow, fleet operators are utilizing more trailers to expand their services. To maintain operational efficiency, it is crucial for fleet owners to ensure that their trailers are equipped with high-quality, reliable tires. Regular tire maintenance and timely replacement are essential to avoid performance issues, reduce operational costs, and increase the lifespan of the vehicle fleet. As a result, there is a constant demand for replacement trailer tires, contributing to market growth.

Government Regulations and Safety Standards:

Stringent government regulations and safety standards are another key driver for the US trailer tire market. In recent years, both federal and state authorities have imposed stricter regulations to ensure the safety and performance of commercial vehicles. The Federal Motor Carrier Safety Administration (FMCSA) and other regulatory bodies enforce laws related to tire safety, including specifications on tire size, load capacity, tread depth, and condition. These regulations require that trailers meet high standards, which directly influences the demand for high-performance trailer tires that comply with these safety and regulatory requirements.

Market Restraint

Fluctuating Raw Material Prices:

One of the major restraints affecting the US trailer tire market is the volatility in the prices of raw materials used in tire production, such as rubber, steel, and petroleum-based products. Rubber, in particular, is highly susceptible to fluctuations due to factors such as weather conditions, crop yields, and global demand. This price volatility can significantly impact tire manufacturers’ production costs, leading to higher prices for end consumers. Consequently, fleet owners and other buyers may face increased operating expenses, making trailer tires less affordable, particularly for smaller operators with limited budgets.

Tire Performance vs. Cost Trade-Off:

Another restraint in the US trailer tire market is the ongoing trade-off between tire performance and cost. While high-performance trailer tires offer longer lifespans, better fuel efficiency, and enhanced durability, they often come with a premium price tag. For fleet operators, especially those with tight budgets or those operating on low-margin businesses, the higher initial cost of premium tires can be a significant deterrent. As a result, many businesses may opt for lower-cost tires that do not provide the same level of performance, potentially leading to increased maintenance costs and reduced operational efficiency in the long run.

Market Opportunity

Growth in Electric and Autonomous Trucking:

One of the most significant opportunities in the US trailer tire market is the growth of electric and autonomous trucking. As the transportation industry transitions towards electric vehicles (EVs) and autonomous trucks, the demand for specialized trailer tires that meet the performance and safety requirements of these new technologies is increasing. Electric trucks, which often carry heavier battery packs, require tires that can support their increased weight while maintaining efficiency and durability. Furthermore, autonomous trucks rely on sensors and advanced systems that demand precise and consistent tire performance to ensure safety and reliability on the road.

Expansion in E-Commerce and Last-Mile Delivery:

The continued rise of e-commerce and last-mile delivery services presents a valuable opportunity for the US trailer tire market. As the demand for rapid and efficient delivery grows, more trailers are being used for the transportation of goods over short distances. This shift has increased the demand for specialized trailers and their corresponding tires, particularly those used in urban and regional delivery networks. With more packages being shipped directly to consumers’ homes, delivery companies require trailers that can handle frequent stops and starts while ensuring minimal downtime due to tire-related issues.

Rising Focus on Sustainability and Eco-Friendly Tires:

There is a growing opportunity in the US trailer tire market to develop and promote eco-friendly tires in response to rising sustainability concerns. Consumers, businesses, and governments are increasingly prioritizing environmentally responsible products and practices, which has led to a greater demand for tires made from sustainable materials and those designed to reduce environmental impact. Manufacturers can leverage this trend by investing in the development of tires that use renewable or recycled materials, such as bio-based rubbers or sustainable steel belts. Additionally, low rolling resistance tires, which improve fuel efficiency and reduce carbon emissions, are becoming a popular choice for fleet operators looking to reduce their environmental footprint.

Market Challenges

Rising Operational Costs:

One of the major challenges facing the US trailer tire market is the rising operational costs associated with manufacturing, distribution, and logistics. The tire manufacturing process is energy-intensive, requiring significant investments in raw materials such as rubber, steel, and synthetic compounds. Additionally, as fuel and labor costs rise, the price of producing and distributing tires increases. This can lead to higher prices for end consumers, which might reduce demand, especially in price-sensitive segments of the market such as small fleet operators and independent truck owners. As the market becomes more competitive, manufacturers must balance the need for cost-effective production while maintaining high-quality standards.

Competition from Imported Tires:

The US trailer tire market faces intense competition from imported tires, especially from countries with lower manufacturing costs, such as China and India. Imported tires are often priced more competitively than domestically produced tires, making them attractive to budget-conscious consumers, particularly in the commercial and fleet sectors. While imported tires may offer cost savings in the short term, there are concerns about the durability, safety, and performance of these tires compared to those made by established US brands. However, many buyers may prioritize lower upfront costs over long-term value, posing a challenge for US manufacturers who must balance price with performance.

Conclusion:

The US trailer tire market is poised for continued evolution, driven by a combination of technological advancements, changing consumer preferences, and growing industry demands. As fleet operators and consumers increasingly prioritize durability, performance, and efficiency, tire manufacturers are under pressure to innovate. The growth of specialized sectors like electric and autonomous trucking, as well as the rise in e-commerce and last-mile delivery, presents ample opportunities for tire companies to tailor their offerings to meet the unique requirements of these markets. Companies that can adapt to these shifts and align their products with emerging trends will likely maintain a competitive edge in the marketplace.

However, the market also faces significant challenges, particularly in terms of rising operational costs, competition from imported tires, and the increasing regulatory focus on sustainability. The manufacturing of trailer tires is highly dependent on raw materials, and fluctuations in the cost of these materials, along with supply chain disruptions, can impact profitability. Moreover, the pressure to meet stringent environmental standards is pushing manufacturers to develop more eco-friendly and recyclable products, which may require significant investment in R&D. For US manufacturers, staying ahead of these challenges will require a fine balance between cost-effectiveness, innovation, and compliance with evolving regulations.

As tire technology continues to advance, the integration of smart tire solutions is one of the most significant trends in the US trailer tire market. Fleet operators are increasingly adopting smart tire systems that use sensors to monitor tire pressure, temperature, and wear in real-time, offering substantial cost savings and safety improvements. The demand for these technologically advanced solutions is likely to grow as more fleet managers seek to optimize tire performance and extend tire lifespan through proactive maintenance. For manufacturers, this presents an opportunity to develop next-generation trailer tires that incorporate IoT connectivity and data analytics to provide fleet operators with actionable insights.

Sustainability remains a critical focus for both consumers and regulators, pushing tire manufacturers to adopt environmentally friendly practices and materials. As the pressure for reducing the carbon footprint of the transportation industry intensifies, tire companies are expected to accelerate their efforts to develop tires that are made from renewable or recycled materials and are easier to recycle at the end of their life cycle. Companies that can lead the way in sustainable tire manufacturing are likely to find significant demand, particularly from fleet operators who are increasingly committed to green practices.

Ultimately, the future of the US trailer tire market depends on manufacturers’ ability to innovate, adapt to emerging technologies, and respond to both operational and environmental challenges. By leveraging technological advancements, such as smart tire solutions and low rolling resistance technologies, and meeting the increasing demand for sustainable products, tire manufacturers can continue to capture market share and remain competitive. As the market matures and evolves, those that invest in innovation and sustainability while navigating competitive pressures will be well-positioned to succeed in the years ahead.

Market Breakup By Trailer Type

Market Breakup By Construction

Market Breakup By Rim Size

Market Breakup By Material

Market Breakup By Distribution Channel

Market Breakup By Aftermarket

Regional Analysis

The report has been prepared after analysing and reviewing numerous factors that denotes the regional development such as economic, environmental, social, technological, and political inputs of the country. The researchers have closely analysed the data of revenue, production, and manufacturers of each county. These analyses will help to identify the important areas as potential worth of investment in the upcoming years.

The US Trailer Tires Market has shown steady growth over the past few years, and this trend is expected to continue in the coming decade. In 2020, the market was valued at $ 3417.80 million, and it is forecast to grow at a compound annual growth rate (CAGR) of 5.18%, reaching $ 5492.55 million by 2031. This consistent growth is primarily driven by the rising demand for trailers across various industries such as logistics, transportation, and construction, as well as an increased focus on performance, durability, and sustainability in tire manufacturing.

From 2020 to 2023, the market saw incremental growth, from $ 3417.80 million in 2020 to approximately $ 3724.92 million in 2023, with a slight acceleration in the latter years. By 2024, the market is projected to surpass $ 3856.06 million and will continue to expand at a strong pace as the demand for transportation services rises, particularly in e-commerce and freight sectors. As industries like freight, agriculture, and manufacturing expand, the need for trailer tires—capable of withstanding long-distance, heavy-duty transportation—will increase.

The growth of the market is also supported by the technological advancements in tire design and materials. Manufacturers are focusing on developing tires with higher durability, lower rolling resistance, and longer lifespans to reduce operational costs for fleet owners. Additionally, the growing trend toward sustainable tire solutions, such as tires made from renewable or recycled materials, is likely to influence the market significantly. As consumer and regulatory pressures increase for eco-friendly products, trailer tire manufacturers are working towards meeting sustainability standards without compromising tire performance.

Looking ahead, the market is poised to maintain steady growth through 2025 and beyond. By 2025, the market size is projected to reach $ 4004.88 million and is expected to continue expanding steadily, driven by both industry needs and consumer demand for more technologically advanced tire solutions. As more fleets adopt smart tire technologies and other innovations aimed at improving fleet efficiency and reducing tire wear, the market is expected to further benefit from these advancements, contributing to both increased demand and enhanced competition among tire manufacturers.

By 2030, the market is expected to exceed $5156.21 million, representing a significant leap from the earlier years of the decade. The ongoing adoption of new tire technologies, coupled with the rising need for cost-effective and durable trailer tires, will drive this sustained growth. This trajectory indicates that the US trailer tire market will continue to thrive, with increasing investments in R&D and innovations that cater to the evolving needs of the transportation and logistics sectors, ensuring the market’s health and dynamism through the end of the decade.

Competitive Landscape

This section of the report identifies various key manufacturers of the market. It helps the reader understand the strategies and collaborations that players are focusing on combat competition in the market. The reader can will get an updated information on their revenue of manufacturers, product portfolio, recent development and expansion plans during the forecast period

Major players operating in the US Trailer Tires market are:

The US trailer tires market is experiencing steady growth driven by increased demand for trailers in various industries such as transportation, logistics, construction, and agriculture. As the trucking industry continues to expand, so does the need for reliable trailer tires that offer durability, fuel efficiency, and safety. In particular, the rise of e-commerce and the growing demand for goods transportation have been key factors contributing to the growth of the trailer industry, and by extension, the trailer tires market. Manufacturers are responding to this demand by introducing tires designed for longer mileage and better fuel efficiency, which are important factors for logistics companies aiming to reduce operational costs.

A significant trend in the US trailer tires market is the shift towards radial tires over bias-ply tires. Radial tires are gaining popularity due to their superior durability, better fuel efficiency, and longer lifespan. This shift is being fueled by advancements in tire technology, including innovations in tread design and material science, which have improved the performance and longevity of radial tires. Furthermore, radial tires are considered safer for long-distance hauling, which makes them a preferred choice for trailer owners operating on highways and rough terrains.

Environmental sustainability is another key trend influencing the US trailer tires market. Manufacturers are increasingly focused on producing eco-friendly tires that use less energy during production and offer better fuel economy for trailers. The incorporation of sustainable materials, such as recycled rubber and silica compounds, is helping to reduce the carbon footprint of trailer tires. Additionally, the demand for low rolling resistance tires is growing, as these tires improve fuel efficiency and reduce emissions, aligning with the trucking industry’s push towards sustainability and reducing operational costs.

In terms of tire maintenance, there is an increasing trend towards advanced tire monitoring technologies. The integration of sensors and telematics systems in tires allows for real-time monitoring of tire pressure, temperature, and overall health. These technologies help prevent tire failures, improve fleet management efficiency, and extend the lifespan of trailer tires. As fleets adopt these technologies to enhance operational safety and minimize downtime, the US trailer tires market is seeing a rise in demand for tires compatible with advanced monitoring systems, which adds an additional layer of convenience and safety for commercial vehicle operators.

Chapter 1. Introduction

1.1. Report description

1.2. Key market segments

1.3. Regional Scope

1.4. Executive Summary

Chapter 2. Research Methodology

2.1. Secondary Research

2.2. Primary Research

2.3. Secondary Analyst Tools and Models

Chapter 3. Market Dynamics

3.1. Market driver analysis

3.2. Market restraint analysis

3.3. Market Opportunity

3.4. Market Challenges

3.5. Impact analysis of COVID-19 on the Trailer Tires market

Chapter 4. Market Variables and Outlook

4.1. SWOT Analysis

4.1.1. Strengths

4.1.2. Weaknesses

4.1.3. Opportunities

4.1.4. Threats

4.2. Supply Chain Analysis

4.3. PESTEL Analysis

4.3.1. Political Landscape

4.3.2. Economic Landscape

4.3.3. Social Landscape

4.3.4. Technological Landscape

4.3.5. Environmental Landscape

4.3.6. Legal Landscape

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitute

4.4.4. Threat of New Entrant

4.4.5. Competitive Rivalry

Chapter 5. Trailer Tires Market: Trailer Type Estimates & Trend Analysis

5.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

5.2. Incremental Growth Analysis and Infographic Presentation

5.2.1. Travel Trailer Tires

5.2.1.1. Market Size & Forecast, 2020-2031

5.2.2. Utility Trailer Tires

5.2.2.1. Market Size & Forecast, 2020-2031

5.2.3. Boat Trailer Tires

5.2.3.1. Market Size & Forecast, 2020-2031

5.2.4. House Trailer Tires

5.2.4.1. Market Size & Forecast, 2020-2031

5.2.5. Other Trailer Tires (Motorcycle, ATV, Cargo)

5.2.5.1. Market Size & Forecast, 2020-2031

Chapter 6. Trailer Tires Market: By Construction Estimates & Trend Analysis

6.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

6.2. Incremental Growth Analysis and Infographic Presentation

6.2.1. Bias Ply Tires

6.2.1.1. Market Size & Forecast, 2020-2031

6.2.2. Radial Ply Tires

6.2.2.1. Market Size & Forecast, 2020-2031

Chapter 7. Trailer Tires Market: By Rim Size Services Estimates & Trend Analysis

7.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

7.2. Incremental Growth Analysis and Infographic Presentation

7.2.1. Small Trailer Tires (<=8″)

7.2.1.1. Market Size & Forecast, 2020-2031

7.2.2. Medium Trailer Tires (12-15″)

7.2.2.1. Market Size & Forecast, 2020-2031

7.2.3. Large Trailer Tires (>16″)

7.2.3.1. Market Size & Forecast, 2020-2031

Chapter 8. Trailer Tires Market: By Material Estimates & Trend Analysis

8.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

8.2. Incremental Growth Analysis and Infographic Presentation

8.2.1. Rubber Tires

8.2.1.1. Market Size & Forecast, 2020-2031

8.2.2. Solid Tires

8.2.2.1. Market Size & Forecast, 2020-2031

Chapter 9. Trailer Tires Market: By Distribution Channel of Fire Safety Products and Materials Estimates & Trend Analysis

9.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

9.2. Incremental Growth Analysis and Infographic Presentation

9.2.1. Original Equipment Manufacturers (OEM)

9.2.1.1. Market Size & Forecast, 2020-2031

9.2.2. Aftermarket

9.2.2.1. Market Size & Forecast, 2020-2031

Chapter 10. Trailer Tires Market: By Aftermarket Estimates & Trend Analysis

10.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

10.2. Incremental Growth Analysis and Infographic Presentation

10.2.1. Tire Only Sales

10.2.1.1. Market Size & Forecast, 2020-2031

10.2.2. Tire/Wheel Assembly Sales

10.2.2.1. Market Size & Forecast, 2020-2031

Chapter 11. Trailer Tires Market: US Estimates & Trend Analysis

11.1. Trailer Tires Market value share and forecast, (2020 to 2031), (USD Million)

11.2. Incremental Growth Analysis and Infographic Presentation

11.3. U.S.

11.3.1.1. Market Size & Forecast, 2020-2031

Chapter 12. Competitive Landscape

12.1. Company Market Share Analysis

12.2. Vendor Landscape

12.3. Competition Dashboard

Chapter 13. Company Profiles

13.1. Business Overview, Product Landscape, Financial Performanceand Company Strategies for below companies

13.1.1. Michelin North America

13.1.1.1. Company Overview

13.1.1.2. Financial Performance

13.1.1.3. Product Benchmarking

13.1.1.4. Geographic Footprint

13.1.1.5. Strategic Initiatives

13.1.2. Goodyear Tire & Rubber Company

13.1.2.1. Company Overview

13.1.2.2. Financial Performance

13.1.2.3. Product Benchmarking

13.1.2.4. Geographic Footprint

13.1.2.5. Strategic Initiatives

13.1.3. Bridgestone Americas

13.1.3.1. Company Overview

13.1.3.2. Financial Performance

13.1.3.3. Product Benchmarking

13.1.3.4. Geographic Footprint

13.1.3.5. Strategic Initiatives

13.1.4. Continental Tire

13.1.4.1. Company Overview

13.1.4.2. Financial Performance

13.1.4.3. Product Benchmarking

13.1.4.4. Geographic Footprint

13.1.4.5. Strategic Initiatives

13.1.5. Pirelli Tire North America

13.1.5.1. Company Overview

13.1.5.2. Financial Performance

13.1.5.3. Product Benchmarking

13.1.5.4. Geographic Footprint

13.1.5.5. Strategic Initiatives

13.1.6. Cooper Tire & Rubber Company

13.1.6.1. Company Overview

13.1.6.2. Financial Performance

13.1.6.3. Product Benchmarking

13.1.6.4. Geographic Footprint

13.1.6.5. Strategic Initiatives

13.1.7. Firestone Tire and Rubber Company

13.1.7.1. Company Overview

13.1.7.2. Financial Performance

13.1.7.3. Product Benchmarking

13.1.7.4. Geographic Footprint

13.1.7.5. Strategic Initiatives

13.1.8. Kumho Tire USA

13.1.8.1. Company Overview

13.1.8.2. Financial Performance

13.1.8.3. Product Benchmarking

13.1.8.4. Geographic Footprint

13.1.8.5. Strategic Initiatives

13.1.9. Yokohama Tire Corporation

13.1.9.1. Company Overview

13.1.9.2. Financial Performance

13.1.9.3. Product Benchmarking

13.1.9.4. Geographic Footprint

13.1.9.5. Strategic Initiatives

13.1.10. BFGoodrich Tires

13.1.10.1. Company Overview

13.1.10.2. Financial Performance

13.1.10.3. Product Benchmarking

13.1.10.4. Geographic Footprint

13.1.10.5. Strategic Initiatives

13.1.11. Others

13.1.11.1. Company Overview

13.1.11.2. Financial Performance

13.1.11.3. Product Benchmarking

13.1.11.4. Geographic Footprint

13.1.11.5. Strategic Initiatives

Chapter 14. Conclusion

By clicking the “Download PDF” button, you are agreeing to the Terms of Use and Privacy Policy. We respect your privacy rights and safegaurd your personal information. We prevent the disclosure of personal information. We prevent the disclosure of personal information to third parties. Soon our team executive will contact you !

Our Executive will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

The report incorporates an analysis of factors that promote market growth. The report introduces the competitive landscape of the global market. This also provides a range of different market segments and applications that may affect the market in the future. The analysis is based on current market trends and historical growth data. It includes detailed market segmentation, regional analysis, and industry competition pattern.

The report effectively assesses the current market size and provides industry forecasts. The value of this market in 2019 is $XXX million, and the compound annual growth rate during 2021-2027 is expected to be XX%. (*Note: XX values will be given in final report)

We use data from the demand and supply side and paid databases. Our report mentions all the sources and methods used to collect data and information.

Yes, we provide country-specific data in reports and custom formats. In our report, we cover major countries and regions. However, if a specific area is required, we will happily provide the data that you need.

Yes, we will consider the scope to provide market share information and insights. This service is part of a custom requirement.

Yes, we will provide several hours of analyst support to solve your problem. Please contact our sales representative and will schedule a meeting with our analyst.

Yes, we provide specific sections of the report. Please contact our sales representative.

The Market Research Corridor contains a database of reports on various industries, but not all reports are listed on the website. Please contact our sales team according to your requirements.

We provide customers with targeted and specific objective-based research. You can contact an analyst for a product review to get an opinion. You can state your custom requirements and we will provide you with the best features.

Customization helps organizations gain insight into specific market segments and areas of interest. Therefore, Market Research Corridor provides customized report information according to business needs for strategic calls.

We work with customers all over the world. So far, we have cooperated with customers from other countries. Our perspective means we know what’s going on in your local market and what’s happening elsewhere in the world. We have cooperated with businesses like you. Market Research Corridor benefits from completing numerous consulting projects across industries. This is whatever you do, chances are we already have very similar experiences.

Market Research Corridor exploring new markets, developing new products, or leveraging niche growth opportunities, we have reports to accelerate and enhance your strategy.

Want us to send you latest updates of the current trends, insights, and more, signup to our newsletter (for alerts, special offers, and discounts).