Get Covid-19 Impact Analysis with Sample Pages

Global Cast Polyurethane Products Market Size, Share & Trend Analysis- By Type, By End-Use Industry, By Application, By Hardness, By Processing Method – Regional Outlook, Competitive Tactics, and Segment Forecast to 2031.The worldwide market for Cast Polyurethane Products is anticipated to exhibit a compounded annual growth rate (CAGR) of 5.13% during the period spanning from 2023 to 2031. Notably, the market’s valuation in 2021 stood at USD 2242.56 million, and this valuation is poised to ascend significantly to reach USD 3686.96 million by the concluding year of the aforementioned period.

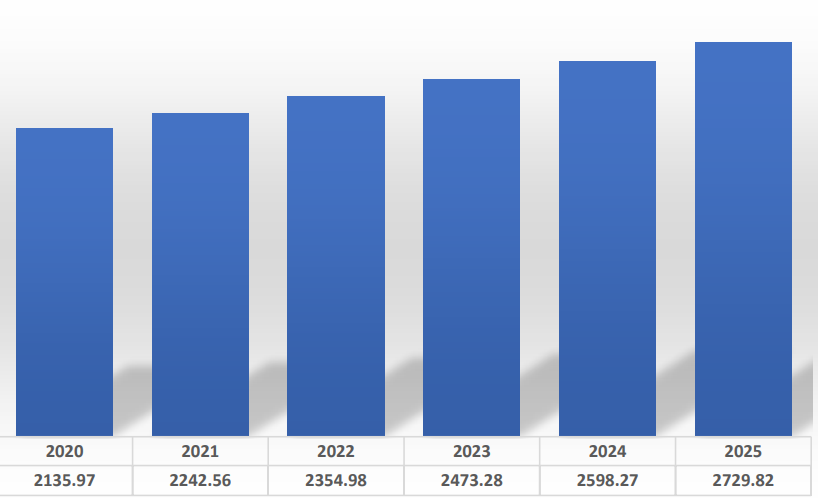

GLOBAL CAST POLYURETHANE PRODUCTS MARKET SIZE, (2020-2025), (USD MILLION)

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

In the period spanning from 2020 to 2025, the global market size for Cast Polyurethane Products demonstrated a consistent upward trajectory, as illustrated in above. Commencing at $2135.97 million in 2020, the market experienced successive growth, reaching $2729.82 million by 2025.

GLOBAL CAST POLYURETHANE PRODUCTS MARKET SIZE, (2026-2031), (USD MILLION)

The trajectory of growth is expected to continue from 2026 to 2031, as depicted in above. Forecasts indicate a steady expansion in the global market for Cast Polyurethane Products, with values progressing from $2868.77 million in 2026 to an estimated $3686.96 million in 2031. This extrapolated growth signifies a Compound Annual Growth Rate (CAGR) of 5.13% during the period from 2023 to 2031.

The global market for Cast Polyurethane Products is a dynamic landscape, witnessing robust growth across different type, End-Use Industry, Application, Hardness and Processing Method.

By Type

The global cast polyurethane market is segmented by type into cast polyurethane sheets, rods, tubes, custom parts, and others. In 2021, the cast polyurethane sheets segment was the largest, accounting for 4.97% of the total market revenue. This is due to the wide range of applications of cast polyurethane sheets, including in the automotive, construction, and electrical and electronics industries.

The cast polyurethane rods segment is expected to grow at the fastest CAGR of 5.21% over the forecast period. This growth is attributed to the increasing demand for cast polyurethane rods in the aerospace and defense industries. Cast polyurethane rods are used in the manufacturing of lightweight and high-strength components for aircraft and spacecraft.

The cast polyurethane tubes segment is also expected to witness significant growth over the forecast period. This growth is attributed to the increasing demand for cast polyurethane tubes in the oil and gas industry. Cast polyurethane tubes are used in the manufacturing of flexible and durable pipes and hoses for the transportation of oil and gas.

The cast polyurethane custom parts segment is expected to grow at a steady CAGR over the forecast period. This growth is attributed to the increasing demand for customized cast polyurethane parts in a variety of industries, including automotive, construction, and electrical and electronics.

The others segment includes cast polyurethane foams, coatings, and adhesives. This segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the increasing demand for cast polyurethane foams in the construction and furniture industries. Cast polyurethane foams are used in the manufacturing of insulation materials and cushioning materials.

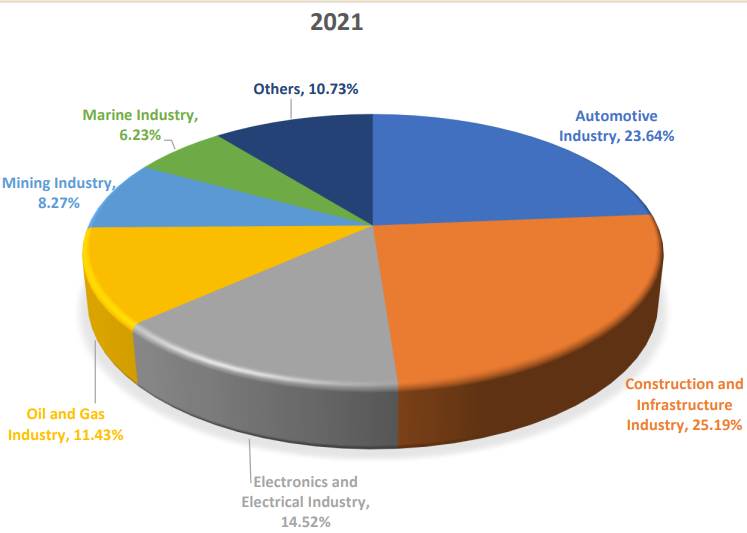

By End Use Industry

The global cast polyurethane market is segmented by end-use industry into automotive, construction and infrastructure, electronics and electrical, oil and gas, mining, marine, and others. In 2021, the automotive industry was the largest end-use industry for cast polyurethane, accounting for 4.75% CAGR. This is due to the wide range of applications of cast polyurethane in the automotive industry, including in the manufacturing of interior and exterior components, such as seats, dashboards, bumpers, and spoilers.

The construction and infrastructure industry is expected to be the fastest-growing end-use industry for cast polyurethane over the forecast period. This growth is attributed to the increasing demand for cast polyurethane in the construction of energy-efficient buildings and infrastructure. Cast polyurethane is used in the manufacturing of insulation materials, roofing membranes, and waterproofing materials.

The electronics and electrical industry is also expected to witness significant growth over the forecast period. This growth is attributed to the increasing demand for cast polyurethane in the manufacturing of electronic devices and components. Cast polyurethane is used in the manufacturing of circuit boards, connectors, and other electronic components.

The oil and gas industry, mining industry, marine industry, and other industries are also expected to contribute to the growth of the global cast polyurethane market over the forecast period. Cast polyurethane is used in the manufacturing of a variety of products in these industries, such as oil and gas hoses, mining equipment, and marine components.

Cast polyurethane is used in the manufacturing of mining equipment, such as flotation cells and mill liners. The increasing demand for minerals and metals is driving the demand for cast polyurethane in the mining industry.

Cast polyurethane is used in the manufacturing of marine components, such as boat fenders and propellers. The increasing demand for recreational and commercial boats is driving the demand for cast polyurethane in the marine industry.

Global Cast Polyurethane Products Market Share, (2021), by End Use Industry

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

By Application

The global cast polyurethane market is segmented by application into elastomers, rigid foams, coatings and adhesives, moldings and extrusions, wheels and rollers, and others. In 2021, elastomers was the largest application segment, accounting for 25.5% of the total market revenue. This is due to the wide range of applications of elastomers, including in the manufacturing of gaskets, seals, and hoses.

Rigid foams is expected to be the fastest-growing application segment over the forecast period. This growth is attributed to the increasing demand for rigid foams in the construction and insulation industries. Rigid foams are used in the manufacturing of insulation materials for buildings and appliances.

Coatings and adhesives is also expected to witness significant growth over the forecast period. This growth is attributed to the increasing demand for coatings and adhesives in the automotive and industrial industries. Coatings and adhesives are used in the manufacturing of vehicles and other industrial products.

Moldings and extrusions, wheels and rollers, and others are also expected to contribute to the growth of the global cast polyurethane market over the forecast period. Cast polyurethane is used in the manufacturing of a variety of products in these application segments, such as moldings and extrusions for automotive and industrial applications, wheels and rollers for material handling and transportation applications, and other products for a variety of industries.

By Hardness

The global cast polyurethane market is segmented by hardness into soft segment (Shore A), medium segment (Shore D), and hard segment (Shore D). In 2021, the soft segment was the largest hardness segment, accounting for 40.06% of the total market revenue. This is due to the wide range of applications of soft cast polyurethane, including in the manufacturing of gaskets, seals, and hoses.

The medium segment is expected to be the fastest-growing hardness segment over the forecast period. This growth is attributed to the increasing demand for medium cast polyurethane in the construction and automotive industries. Medium cast polyurethane is used in the manufacturing of insulation materials and automotive components.

The hard segment is also expected to witness significant growth over the forecast period. This growth is attributed to the increasing demand for hard cast polyurethane in the industrial and mining industries. Hard cast polyurethane is used in the manufacturing of industrial parts and mining equipment.

By Processing Method

Injection molding is the most widely used plastic processing method, accounting for over 40.44% of the global market in 2021. Injection molding is a versatile process that can be used to produce a wide range of plastic products, from simple components to complex assemblies.

Open casting, centrifugal casting, and compression molding are other important plastic processing methods. Open casting is used to produce large, flat plastic sheets or films. Centrifugal casting is used to produce hollow plastic products, such as pipes and tubes. Compression molding is used to produce molded plastic products, such as bottle caps and closures.

Driver, Restraint, Challenge and Opportunities Analysis

Market Driver

Industrial Growth and Modernization:

One of the primary drivers is the ongoing industrial growth and modernization across sectors like manufacturing, construction, automotive, and mining. Cast polyurethane products find extensive applications in these industries due to their versatility, durability, and wear resistance. As these industries expand and upgrade their machinery and equipment, the demand for high-performance polyurethane components such as seals, gaskets, wheels, and rollers increases. The need for improved operational efficiency, reduced maintenance costs, and extended equipment lifespans further fuels the demand for cast polyurethane products.

Infrastructure Development:

Infrastructure development projects, including road construction, bridges, and public utilities, are on the rise globally. Cast polyurethane products play a crucial role in these projects, as they are used in the production of items like concrete stamps, architectural elements, and noise barriers. As governments and private investors continue to invest in infrastructure to support economic growth and urbanization, the market for cast polyurethane products is likely to witness sustained growth.

Customization and Tailored Solutions:

The ability to provide customized and tailored solutions is another driver. Cast polyurethane products can be engineered to meet precise specifications in terms of hardness, flexibility, size, and performance characteristics. This customization appeals to industries with unique requirements, such as aerospace, where precision and high-performance materials are essential. This adaptability allows manufacturers to cater to a broad customer base, leading to increased market share.

Globalization and Supply Chain Optimization:

Globalization has facilitated the expansion of the cast polyurethane products market by opening up opportunities in emerging markets. As businesses expand their global presence, they require reliable supply chains for high-quality components. Cast polyurethane product manufacturers are strategically locating production facilities and distribution networks to optimize supply chain efficiencies, reducing lead times and costs, which, in turn, enhances market growth.

Environmental Regulations and Sustainability:

The increasing focus on environmental regulations and sustainability practices has driven innovation in the cast polyurethane industry. Manufacturers are developing eco-friendly formulations that meet stringent environmental standards. As companies seek to reduce their carbon footprint and adopt greener manufacturing processes, the demand for sustainable cast polyurethane products is expected to grow.

Rising Demand for High-Performance Materials:

Many industries are experiencing a growing demand for high-performance materials that can withstand harsh operating conditions, extreme temperatures, and heavy loads. Cast polyurethane products offer exceptional properties such as abrasion resistance, chemical resistance, and load-bearing capacity. As industries seek to improve the durability and longevity of their equipment and components, the demand for these high-performance materials is on the rise.

Market Restraint

Raw Material Price Volatility and Supply Chain Disruptions:

Fluctuations in the prices of raw materials for cast polyurethane production, such as polyols and isocyanates, can pose significant challenges for manufacturers. These price variations can impact production costs, affecting profit margins and pricing strategies. Additionally, supply chain disruptions, geopolitical tensions, or natural disasters can disrupt the availability of raw materials, leading to delays and increased costs.

Environmental Concerns and Regulations:

Increasing environmental awareness and stringent regulatory measures can impede the market growth of cast polyurethane products. The production and disposal of certain polyurethane materials may raise environmental concerns due to their non-biodegradable nature and potential impact on ecosystems. Compliance with environmental regulations may require additional investments in eco-friendly formulations and waste management solutions, adding to production costs.

Competitive Market Landscape and Pricing Pressure:

The global cast polyurethane products market is highly competitive, with numerous manufacturers vying for market share. Intense competition can lead to pricing pressures, impacting profit margins for businesses. Moreover, the presence of both established and emerging players intensifies the struggle for market dominance, necessitating continuous innovation and cost-efficiency strategies.

Market Opportunity

Growing Demand in Emerging Markets:

Emerging markets, particularly in Asia-Pacific, South America, and Africa, present significant growth opportunities for the cast polyurethane products market. Rapid urbanization, industrialization, and increasing infrastructure projects in these regions drive the demand for polyurethane components, creating a potential market for manufacturers to expand their operations.

Technological Advancements and Material Innovation:

The continuous evolution of technology provides opportunities for innovation in the cast polyurethane industry. Developing advanced formulations and manufacturing processes can lead to enhanced product performance, durability, and cost-efficiency. Innovations in bio-based or recycled polyurethane materials align with sustainability goals and tap into the growing eco-friendly product segment.

Customization and Product Diversification:

The ability to provide customized solutions to meet specific end-user requirements is a significant opportunity. Manufacturers can diversify their product offerings by tailoring properties such as hardness, flexibility, and resilience to cater to different industries, thus expanding their customer base and market reach.

Focus on Sustainable Practices and Circular Economy:

The increasing focus on sustainability and the circular economy presents a notable opportunity for the cast polyurethane products market. Manufacturers can adopt recycling and waste reduction strategies, incorporating recycled materials into production processes, and aligning with circular economy principles to create eco-friendly products and gain a competitive edge.

Market Challenges

Technology Obsolescence and Rapid Technological Changes:

Rapid advancements in technology may render existing manufacturing processes and equipment obsolete. Manufacturers need to continually upgrade their technology to stay competitive and meet evolving customer demands. Adapting to new technologies poses challenges in terms of investment, training, and integrating these technologies seamlessly into existing operations.

Quality Control and Consistency:

Maintaining consistent product quality is a challenge in the production of cast polyurethane products. Achieving uniform hardness, durability, and other desired properties across a range of products requires stringent quality control measures. Any deviation in quality can result in product defects and customer dissatisfaction, impacting the market reputation and brand image.

Recent Developments,

1) In October 2020, Argonics announces the consolidation of its manufacturing plants into one plant, located at its Michigan facility.

2) In June 2023, Mearthane Products Corporation Acquires American Urethane.

3) In January 2020, Mearthane acquires PMI, expands polyurethane portfolio

In conclusion, the global cast polyurethane products market is positioned for a promising future, fueled by a combination of factors such as increasing industrialization, technological advancements, sustainability initiatives, and a growing focus on high-performance materials. The adaptability and versatility of cast polyurethane products make them indispensable across a spectrum of industries, driving steady market growth. Industries such as automotive, construction, manufacturing, and healthcare are expected to remain key drivers of demand, with their continuous expansion and modernization necessitating reliable, durable, and resilient materials.

Looking ahead, sustainability will be a pivotal aspect shaping the future of the cast polyurethane products market. As environmental consciousness grows and regulations tighten, the industry will increasingly focus on developing eco-friendly alternatives and incorporating recycled materials into manufacturing processes. This will not only align with sustainability goals but also appeal to environmentally conscious consumers and businesses. Furthermore, advancements in material science and production techniques will lead to enhanced properties, customization capabilities, and cost-efficiency, driving market growth and diversification.

Globalization and the rise of emerging markets will continue to play a significant role in shaping the market landscape. Manufacturers will leverage the opportunities presented by these markets, tailoring products to meet specific regional demands and expanding their presence. Additionally, the ongoing digital revolution will drive the adoption of automation, data analytics, and smart manufacturing practices, boosting efficiency and productivity across the production cycle. As the world recovers from the impact of the COVID-19 pandemic, a renewed focus on resilient supply chains and rapid response mechanisms will further bolster the market’s growth potential.

In summary, the global cast polyurethane products market is poised for growth, driven by technological advancements, sustainability imperatives, and expanding applications across various industries. Industry players that embrace innovation, sustainability, and technological integration will likely lead the market, meeting the evolving demands of a rapidly changing global landscape and securing a prosperous future for the cast polyurethane products market.

Market Breakup By Type

Cast Polyurethane Sheets

Cast Polyurethane Rods

Cast Polyurethane Tubes

Cast Polyurethane Custom Parts

Others

Market Breakup By End-User

Automotive Industry

Construction and Infrastructure Industry

Electronics and Electrical Industry

Oil and Gas Industry

Mining Industry

Marine Industry

Others

Market Breakup By Application

Elastomers

Rigid foams

Coatings and adhesives

Moldings and extrusions

Wheels and rollers

Others

Market Breakup By Hardness

Soft Segment (Shore A)

Medium Segment (Shore D)

Hard Segment (Shore D)

Market Breakup By Processing Method

Injection Molding

Open Casting

Centrifugal Casting

Compression Molding

Regional Analysis

The report has been prepared after analysing and reviewing numerous factors that denotes the regional development such as economic, environmental, social, technological, and political inputs of the country. The researchers have closely analysed the data of revenue, production, and manufacturers of each county. These analyses will help the to identify the important areas as potential worth of investment in the upcoming years.

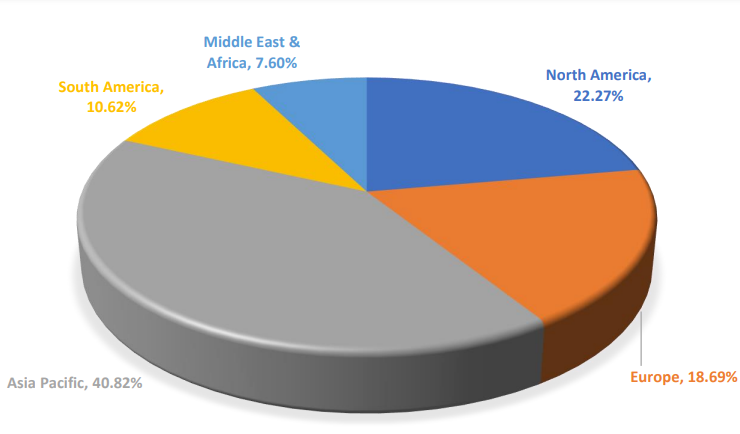

GLOBAL CAST POLYURETHANE PRODUCTS MARKET SHARE, (2022), BY REGION

Source: Primary Research, Secondary Research, White Paper, Others Publications, Company Website

North America, particularly the United States and Canada, is a significant market for cast polyurethane products. In 2020, the region recorded revenues of USD 524.56 million, a figure projected to reach USD 830.40 million by 2031, growing at a CAGR of 5.25%. The region is characterized by a well-established industrial and manufacturing sector, driving the demand for cast polyurethane across various applications including automotive, construction, industrial machinery, and more. Stringent regulatory standards, especially concerning product safety and environmental impact, influence the market dynamics and product innovations in this region.

Europe is a mature market for cast polyurethane products, driven by a robust automotive sector, industrial manufacturing, and a growing emphasis on sustainable and eco-friendly materials. In 2020, the region recorded revenues of USD 400.49 million, a figure projected to reach USD 679.24 million by 2031, growing at a CAGR of 4.96%. Countries like Germany, France, and the UK are major consumers and producers of cast polyurethane products. Regulatory frameworks focusing on energy efficiency and reduced emissions propel the adoption of polyurethane-based solutions in the region.

Asia Pacific is a significant and rapidly growing market for cast polyurethane products. In 2020, the region recorded revenues of USD 866.44 million, a figure projected to reach USD 1,547.39 million by 2031, growing at a CAGR of 5.45%. Countries like China, India, Japan, and South Korea are key contributors to the demand owing to their expanding industrial sectors, infrastructure development, and a thriving automotive industry. Additionally, the region’s robust growth in construction, mining, and electronics further fuels the demand for cast polyurethane across various applications.

South America, with countries like Brazil and Argentina, exhibits a growing demand for cast polyurethane products, primarily driven by the automotive, mining, and construction sectors. In 2020, the region recorded revenues of USD 250.08 million, a figure projected to reach USD 362.56 million by 2031, growing at a CAGR of 4.23%. Economic development, urbanization, and increasing investments in infrastructure contribute to the rising consumption of polyurethane-based materials in the region.

The Middle East and Africa are witnessing a gradual growth in the utilization of cast polyurethane products. In 2020, the region recorded revenues of USD 164.04 million, a figure projected to reach USD 267.37 million by 2031, growing at a CAGR of 4.58%. The demand is driven by infrastructure development, oil and gas projects, mining activities, and a growing awareness of the benefits of polyurethane in applications like industrial machinery, pipelines, and construction.

Competitive Landscape

This section of the report identifies various key manufacturers of the market. It helps the reader understand the strategies and collaborations that players are focusing on combat competition in the market. The reader can will get an updated information on their revenue of manufacturers, product portfolio, recent development and expansion plans during the forecast period

Major players operating in the Global Cast Polyurethane Products market are:

TPC Inc.(Turret Punch Company)

Perfect Polymers

PARAKH RUBBER HOUSE

Precision Urethane & Machine, Inc

Argonics, Inc.

Plan Tech, Inc.

Mearthane Products Corporate

Fallline Corporation

Uniflex Inc.

Weaver Industries, Inc.

American Urethane

Others

The global cast polyurethane products market has experienced substantial growth over the years, driven by factors such as increasing industrialization, growing demand from end-use industries like automotive, construction, and manufacturing, and the versatility and superior properties of polyurethane materials. These materials offer exceptional abrasion resistance, impact strength, flexibility, and durability, making them ideal for a wide range of applications. Additionally, a heightened focus on sustainability and the development of bio-based polyurethane materials have emerged as key trends, reflecting the industry’s commitment to environmental responsibility.

One of the notable trends shaping the market is the growing adoption of cast polyurethane products in the automotive sector, particularly for manufacturing components like wheels, bumpers, seals, and suspension systems. The demand for lightweight and fuel-efficient vehicles has propelled the use of polyurethane, contributing to reduced vehicle weight and improved fuel efficiency. Moreover, advancements in material formulations and processing technologies have resulted in enhanced performance characteristics, further driving their adoption across various end-use sectors.

Another trend is the expanding use of cast polyurethane products in the construction industry, especially for manufacturing insulation materials, sealants, coatings, and roofing systems. The remarkable insulation properties of polyurethane make it a preferred choice for energy-efficient buildings. Additionally, the construction of smart cities and sustainable infrastructure projects is expected to fuel the demand for polyurethane products in the coming years.

Looking ahead, the global cast polyurethane products market holds significant future scope, propelled by ongoing research and development initiatives focused on bio-based and eco-friendly materials. The emphasis on circular economy models, recycling technologies, and sustainable production processes is likely to gain traction, influencing the market landscape. Moreover, the adoption of cast polyurethane products in emerging economies, driven by urbanization, industrialization, and infrastructural development, is expected to present lucrative opportunities for market growth.

In conclusion, the global cast polyurethane products market is poised for substantial growth, supported by an array of applications across diverse industries. Sustainability, product innovation, and the adoption of polyurethane materials in emerging economies are anticipated to be key drivers for the market in the foreseeable future. As technological advancements and environmental consciousness continue to shape the industry, the landscape of the cast polyurethane products market is likely to evolve, offering promising prospects for manufacturers, investors, and stakeholders alike. For the most recent and accurate insights, continuous monitoring of market trends and advancements is essential.

About Us:

Market Research Corridor is a global market research and management consulting firm serving businesses, non-profits, universities and government agencies. Our goal is to work with organizations to achieve continuous strategic improvement and achieve growth goals. Our industry research reports are designed to provide quantifiable information combined with key industry insights. We aim to provide our clients with the data they need to ensure sustainable organizational development.

Contact Us:

Avinash J

Market Research Corridor

Phone : +1 518 250 6491

Email: [email protected]

Table of Contents

Chapter 1. Introduction

1.1. Report description

1.2. Key market segments

1.3. Regional Scope

1.4. Executive Summary

Chapter 2. Research Methodology

2.1. Secondary Research

2.2. Primary Research

2.3. Secondary Analyst Tools and Models

Chapter 3. Market Dynamics

3.1. Market driver analysis

3.2. Market restraint analysis

3.3. Market Opportunity

3.4. Market Challenges

3.5. Impact analysis of COVID-19 on the Cast Polyurethane Products market

Chapter 4. Market Variables and Outlook

4.1. SWOT Analysis

4.1.1. Strengths

4.1.2. Weaknesses

4.1.3. Opportunities

4.1.4. Threats

4.2. Supply Chain Analysis

4.3. PESTEL Analysis

4.3.1. Political Landscape

4.3.2. Economic Landscape

4.3.3. Social Landscape

4.3.4. Technological Landscape

4.3.5. Environmental Landscape

4.3.6. Legal Landscape

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitute

4.4.4. Threat of New Entrant

4.4.5. Competitive Rivalry

Chapter 5. Cast Polyurethane Products Market: Type Estimates & Trend Analysis

5.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

5.2. Incremental Growth Analysis and Infographic Presentation

5.2.1. Cast Polyurethane Sheets

5.2.1.1. Market Size & Forecast, 2020-2031

5.2.2. Cast Polyurethane Rods

5.2.2.1. Market Size & Forecast, 2020-2031

5.2.3. Cast Polyurethane Tubes

5.2.3.1. Market Size & Forecast, 2020-2031

5.2.4. Cast Polyurethane Custom Parts

5.2.4.1. Market Size & Forecast, 2020-2031

5.2.5. Others

5.2.5.1. Market Size & Forecast, 2020-2031

Chapter 6. Cast Polyurethane Products Market: By End Use Industry Estimates & Trend Analysis

6.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

6.2. Incremental Growth Analysis and Infographic Presentation

6.2.1. Automotive Industry

6.2.1.1. Market Size & Forecast, 2020-2031

6.2.2. Construction and Infrastructure Industry

6.2.2.1. Market Size & Forecast, 2020-2031

6.2.3. Electronics and Electrical Industry

6.2.3.1. Market Size & Forecast, 2020-2031

6.2.4. Oil and Gas Industry

6.2.4.1. Market Size & Forecast, 2020-2031

6.2.5. Mining Industry

6.2.5.1. Market Size & Forecast, 2020-2031

6.2.6. Marine Industry

6.2.6.1. Market Size & Forecast, 2020-2031

6.2.7. Others

6.2.7.1. Market Size & Forecast, 2020-2031

Chapter 7. Cast Polyurethane Products Market: Application Estimates & Trend Analysis

7.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

7.2. Incremental Growth Analysis and Infographic Presentation

7.2.1. Elastomers

7.2.1.1. Market Size & Forecast, 2020-2031

7.2.2. Rigid foams

7.2.2.1. Market Size & Forecast, 2020-2031

7.2.3. Coatings and adhesives

7.2.3.1. Market Size & Forecast, 2020-2031

7.2.4. Moldings and extrusions

7.2.4.1. Market Size & Forecast, 2020-2031

7.2.5. Wheels and rollers

7.2.5.1. Market Size & Forecast, 2020-2031

7.2.6. Others

7.2.6.1. Market Size & Forecast, 2020-2031

Chapter 8. Cast Polyurethane Products Market: By Hardness Estimates & Trend Analysis

8.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

8.2. Incremental Growth Analysis and Infographic Presentation

8.2.1. Soft Segment (Shore A)

8.2.1.1. Market Size & Forecast, 2020-2031

8.2.2. Medium Segment (Shore D)

8.2.2.1. Market Size & Forecast, 2020-2031

8.2.3. Hard Segment (Shore D)

8.2.3.1. Market Size & Forecast, 2020-2031

Chapter 9. Cast Polyurethane Products Market: By Processing Method Estimates & Trend Analysis

9.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

9.2. Incremental Growth Analysis and Infographic Presentation

9.2.1. Injection Molding

9.2.1.1. Market Size & Forecast, 2020-2031

9.2.2. Open Casting

9.2.2.1. Market Size & Forecast, 2020-2031

9.2.3. Centrifugal Casting

9.2.3.1. Market Size & Forecast, 2020-2031

9.2.4. Compression Molding

9.2.4.1. Market Size & Forecast, 2020-2031

Chapter 10. Cast Polyurethane Products Market: Regional Estimates & Trend Analysis

10.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

10.2. Incremental Growth Analysis and Infographic Presentation

10.3. North America

10.3.1.1. Market Size & Forecast, 2020-2031

10.4. Europe

10.4.1.1. Market Size & Forecast, 2020-2031

10.5. Asia Pacific

10.5.1.1. Market Size & Forecast, 2020-2031

10.6. Middle East & Africa

10.6.1.1. Market Size & Forecast, 2020-2031

10.7. Latin America

10.7.1.1. Market Size & Forecast, 2020-2031

Chapter 11. Cast Polyurethane Products Market: Country Estimates & Trend Analysis

11.1. Cast Polyurethane Products Market value share and forecast, (2020 to 2031) (USD Million)

11.2. Incremental Growth Analysis and Infographic Presentation

11.3. U.S.

11.3.1.1. Market Size & Forecast, 2020-2031

11.4. Canada

11.4.1.1. Market Size & Forecast, 2020-2031

11.5. Mexico

11.5.1.1. Market Size & Forecast, 2020-2031

11.6. UK

11.6.1.1. Market Size & Forecast, 2020-2031

11.7. France

11.7.1.1. Market Size & Forecast, 2020-2031

11.8. Germany

11.8.1.1. Market Size & Forecast, 2020-2031

11.9. Russia

11.9.1.1. Market Size & Forecast, 2020-2031

11.10. Italy

11.10.1.1. Market Size & Forecast, 2020-2031

11.11. Spain

11.11.1.1. Market Size & Forecast, 2020-2031

11.12. China

11.12.1.1. Market Size & Forecast, 2020-2031

11.13. India

11.13.1.1. Market Size & Forecast, 2020-2031

11.14. Japan

11.14.1.1. Market Size & Forecast, 2020-2031

11.15. Indonesia

11.15.1.1. Market Size & Forecast, 2020-2031

11.16. South Korea

11.16.1.1. Market Size & Forecast, 2020-2031

11.17. Australia

11.17.1.1. Market Size & Forecast, 2020-2031

11.18. Brazil

11.18.1.1. Market Size & Forecast, 2020-2031

11.19. Argentina

11.19.1.1. Market Size & Forecast, 2020-2031

11.20. Saudi Arabia

11.20.1.1. Market Size & Forecast, 2020-2031

11.21. UAE

11.21.1.1. Market Size & Forecast, 2020-2031

11.22. South Africa

11.22.1.1. Market Size & Forecast, 2020-2031

Chapter 12. Competitive Landscape

12.1. Company Market Share Analysis

12.2. Vendor Landscape

12.3. Competition Dashboard

Chapter 13. Company Profiles

13.1. Business Overview, Product Landscape, Financial Performanceand Company Strategies for below companies

13.1.1. TPC Inc.(Turret Punch Company)

13.1.1.1. Company Overview

13.1.1.2. Financial Performance

13.1.1.3. Product Benchmarking

13.1.1.4. Geographic Footprint

13.1.1.5. Strategic Initiatives

13.1.2. Perfect Polymers

13.1.2.1. Company Overview

13.1.2.2. Financial Performance

13.1.2.3. Product Benchmarking

13.1.2.4. Geographic Footprint

13.1.2.5. Strategic Initiatives

13.1.3. PARAKH RUBBER HOUSE

13.1.3.1. Company Overview

13.1.3.2. Financial Performance

13.1.3.3. Product Benchmarking

13.1.3.4. Geographic Footprint

13.1.3.5. Strategic Initiatives

13.1.4. Precision Urethane & Machine, Inc

13.1.4.1. Company Overview

13.1.4.2. Financial Performance

13.1.4.3. Product Benchmarking

13.1.4.4. Geographic Footprint

13.1.4.5. Strategic Initiatives

13.1.5. Argonics, Inc.

13.1.5.1. Company Overview

13.1.5.2. Financial Performance

13.1.5.3. Product Benchmarking

13.1.5.4. Geographic Footprint

13.1.5.5. Strategic Initiatives

13.1.6. Plan Tech, Inc.

13.1.6.1. Company Overview

13.1.6.2. Financial Performance

13.1.6.3. Product Benchmarking

13.1.6.4. Geographic Footprint

13.1.6.5. Strategic Initiatives

13.1.7. Mearthane Products Corporate

13.1.7.1. Company Overview

13.1.7.2. Financial Performance

13.1.7.3. Product Benchmarking

13.1.7.4. Geographic Footprint

13.1.7.5. Strategic Initiatives

13.1.8. Fallline Corporation

13.1.8.1. Company Overview

13.1.8.2. Financial Performance

13.1.8.3. Product Benchmarking

13.1.8.4. Geographic Footprint

13.1.8.5. Strategic Initiatives

13.1.9. Uniflex Inc.

13.1.9.1. Company Overview

13.1.9.2. Financial Performance

13.1.9.3. Product Benchmarking

13.1.9.4. Geographic Footprint

13.1.9.5. Strategic Initiatives

13.1.10. Weaver Industries, Inc.

13.1.10.1. Company Overview

13.1.10.2. Financial Performance

13.1.10.3. Product Benchmarking

13.1.10.4. Geographic Footprint

13.1.10.5. Strategic Initiatives

13.1.11. American Urethane

13.1.11.1. Company Overview

13.1.11.2. Financial Performance

13.1.11.3. Product Benchmarking

13.1.11.4. Geographic Footprint

13.1.11.5. Strategic Initiatives

Chapter 14. Conclusion

By clicking the “Download PDF” button, you are agreeing to the Terms of Use and Privacy Policy. We respect your privacy rights and safegaurd your personal information. We prevent the disclosure of personal information. We prevent the disclosure of personal information to third parties. Soon our team executive will contact you !

Our Executive will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

The report incorporates an analysis of factors that promote market growth. The report introduces the competitive landscape of the global market. This also provides a range of different market segments and applications that may affect the market in the future. The analysis is based on current market trends and historical growth data. It includes detailed market segmentation, regional analysis, and industry competition pattern.

The report effectively assesses the current market size and provides industry forecasts. The value of this market in 2019 is $XXX million, and the compound annual growth rate during 2021-2027 is expected to be XX%. (*Note: XX values will be given in final report)

We use data from the demand and supply side and paid databases. Our report mentions all the sources and methods used to collect data and information.

Yes, we provide country-specific data in reports and custom formats. In our report, we cover major countries and regions. However, if a specific area is required, we will happily provide the data that you need.

Yes, we will consider the scope to provide market share information and insights. This service is part of a custom requirement.

Yes, we will provide several hours of analyst support to solve your problem. Please contact our sales representative and will schedule a meeting with our analyst.

Yes, we provide specific sections of the report. Please contact our sales representative.

The Market Research Corridor contains a database of reports on various industries, but not all reports are listed on the website. Please contact our sales team according to your requirements.

We provide customers with targeted and specific objective-based research. You can contact an analyst for a product review to get an opinion. You can state your custom requirements and we will provide you with the best features.

Customization helps organizations gain insight into specific market segments and areas of interest. Therefore, Market Research Corridor provides customized report information according to business needs for strategic calls.

We work with customers all over the world. So far, we have cooperated with customers from other countries. Our perspective means we know what’s going on in your local market and what’s happening elsewhere in the world. We have cooperated with businesses like you. Market Research Corridor benefits from completing numerous consulting projects across industries. This is whatever you do, chances are we already have very similar experiences.

Market Research Corridor exploring new markets, developing new products, or leveraging niche growth opportunities, we have reports to accelerate and enhance your strategy.

Want us to send you latest updates of the current trends, insights, and more, signup to our newsletter (for alerts, special offers, and discounts).